|

If you're one of the many Australians who've purchased a property through a self-managed superannuation fund (SMSF), the Australian Taxation Office (ATO) has provided valuable guidance about how to file your annual tax return.

The ATO said that if you want your SMSF annual return to be processed without delay, you should make sure:

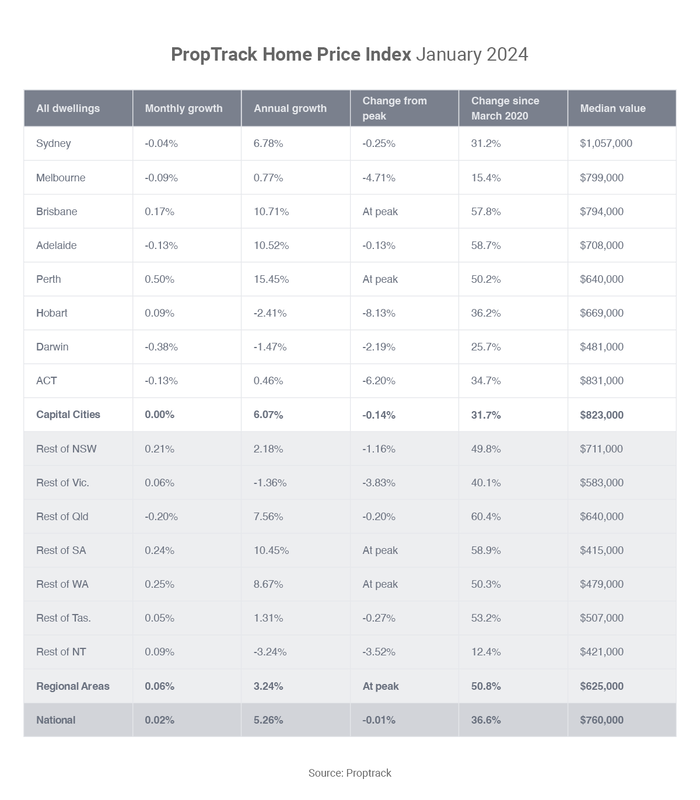

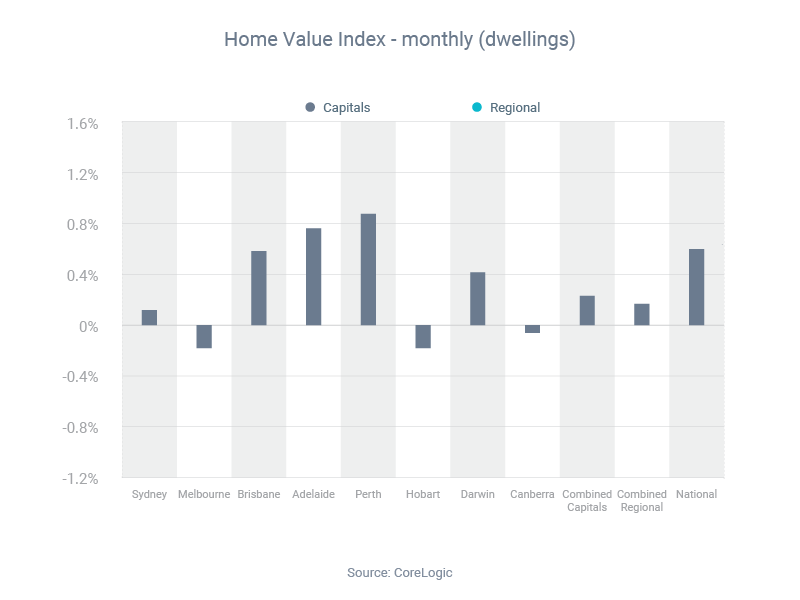

The Australian property market is growing briskly right now and has grown significantly since the pandemic. But the city-by-city performance has been more varied. Over the year to May, the national median price rose 8.3%, according to CoreLogic. But at a city level, growth ranged from a staggering 22.0% increase in Perth to a 0.1% decrease in Hobart. Meanwhile, growth since March 2020 has ranged from a high of 62.6% in Perth to a low of 11.2% in Melbourne. CoreLogic's head of research, Eliza Owen, attributed the contrasting results to diverse market conditions.

“The highest-performing markets have generally come off a low base, with housing conditions and demographic trends relatively weak over the years preceding the pandemic,” she said. “Differences in capital growth trends are marked by the varied supply-demand balances of each city, and in turn migration, affordability factors and dwelling completions influence that supply and demand dynamic.” Ms Owen said annual growth had started to slow across the combined capital cities. “This could mean a slowdown in growth across Brisbane, Perth and Adelaide is on the horizon, and could see the range of growth eventually narrow across the capital cities,” she added. While it’s often said you need a 20% deposit to qualify for a home loan, a significant number of borrowers are securing mortgages with smaller deposits, according to the latest data from APRA, the banking regulator. In the March 2024 quarter, 31.0% of new home loans (by value) had deposits of less than 20%, while 6.2% of new loans had deposits of less than 10%. Generally, you will need to pay lender’s mortgage insurance (LMI) if you purchase a property with a deposit of less than 15-20%. However, some lenders give LMI exemptions to certain professionals, such as doctors, dentists, physiotherapists, lawyers and accountants. While more than three in 10 borrowers are taking out loans with deposits under 20%, these figures are relatively low by historical standards. Back in December 2020, for example, 41.7% of new loans had deposits of less than 20%, while 11.3% had deposits of less than 10%.

This illustrates how banks have tightened their lending standards, to ensure borrowers don’t take on an excessive amount of debt. Yet it’s still possible to buy a property with a small deposit, provided your financial circumstances allow it and you structure your loan application correctly. The federal government has unveiled a series of reforms to the banking sector, which aim to help consumers access lower home loan rates and higher savings accounts rates.

As part of the reforms, Treasury will investigate how behavioural economics could be used in the banking sector to encourage consumers to switch to cheaper home loans and banking products. Also, lenders will be required to make it easier for customers to refinance their mortgage, by ensuring they have direct and easy access to the forms needed to switch. Treasurer Jim Chalmers said these changes would “help bank customers get a better deal, including through more choice, lower prices and better services”. For consumers, that could mean:

Since late 2019, homebuilding costs have increased by nearly 40%, according to a speech by Reserve Bank assistant governor Sarah Hunter, while general inflation (referred to as headline CPI in the graph) has been less than 20%. So why have residential construction costs grown twice as fast? Ms Hunter said one reason is that building materials and labour have “risen sharply” since the pandemic. Another reason is that higher interest rates have made it more expensive for developers to fund their projects. High building costs have partly contributed to “an imbalance between new supply of housing and growth in demand,” according to Ms Hunter. She said there were several ways in which these imbalances may be resolved, including a slowdown in the growth in building costs and an increase in average household size. “But it will not be a quick fix. Demand pressure, and so upward pressure on rents and prices, will remain until new supply comes online,” she said. Here are three things to consider if you’re thinking about building a home in 2024:

The Australian Taxation Office (ATO) has warned property investors it will pay close attention to their reported income and deductions this tax time, with official data showing that about 90% of investors get their tax returns wrong.

ATO assistant commissioner Rob Thomson said general repairs and maintenance on your rental property can be claimed as an immediate deduction – but expenses that are capital in nature (like immediate repairs on a property you just bought or improvements some time after purchase) are not deductible as repairs or maintenance. “We often see landlords making mistakes when it comes to repairs and maintenance deductions on rental properties, so we’re keeping a close eye on this. This year, we’re particularly focused on claims that may have been inflated to offset increases in rental income to get a greater tax benefit,” he said. “You can claim an immediate deduction for general repairs like replacing damaged carpet or a broken window. But if you rip out an old kitchen and put in a new and improved one, this is a capital improvement and is only deductible over time as capital works.” Are you a first home buyer or single parent who wants help getting a property? If so, you’ll be interested to learn that the federal government’s Home Guarantee Scheme (HGS) has now supported more than 150,000 buyers since its inception in January 2020. Eligibility is limited. There are property price caps, which vary from state to state. Income caps also apply – $125,000 for individuals and a combined $200,000 for joint applicants. The HGS consists of three programs:

Of the 150,000 buyers who have used the HGS, 51% have been women and 55% have been under the age of 30, according to Housing Australia, which administers the scheme.

Contact me if you’re thinking about accessing the HGS. I'll let you know if you're able to qualify for the scheme and manage your loan application if you are. Back in March 2020, at the start of the pandemic, 13.38% of new borrowers were choosing fixed-rate loans and 86.62% were choosing variable. But in March 2024, a staggering low of only 1.40% of new loans were fixed, compared to 98.60% variable, according to the Australian Bureau of Statistics.

The reason so many borrowers are going variable right now is because of a widespread belief that interest rates are at or near their peak, which means variable borrowers would benefit from any future rate cuts. Conversely, in July 2021, when interest rates were at record-low levels, 46.02% loans were fixed, while only 53.98% were variable. If you’re wondering whether fixed or variable is right for you, here are the main pros and cons of each option: Property buyers are being forced to compete hard in many markets around Australia, so how can you improve your chances of securing your dream home?

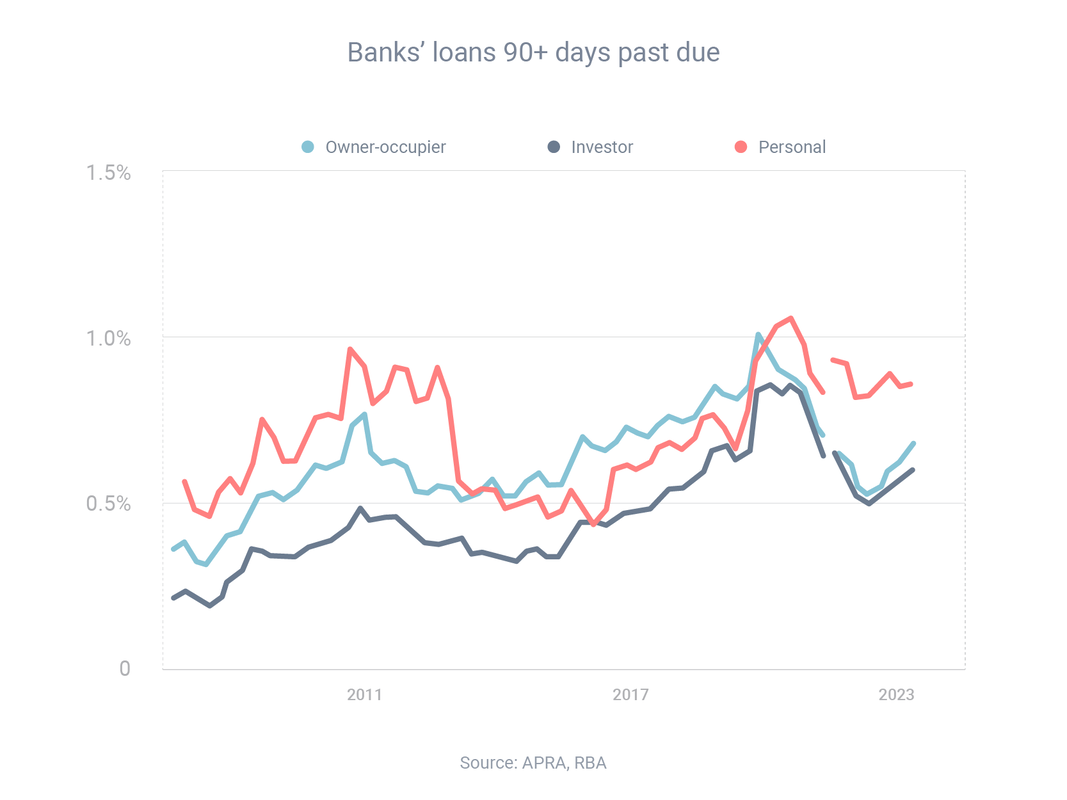

Here are five tips to beat out other buyers: Have a home loan pre-approval in place. This will make you look more attractive in the eyes of real estate agents, because it will position you as a serious buyer who can move quickly if their client accepts your bid. Build good relationships with agents. Real estate agents work for vendors, not buyers, so they prioritise their clients' interests. But if you can establish a good working relationship with agents – even while keeping some of your cards up your sleeve – they might favour your offer over those of other buyers. Be realistic with your offers. If you're buying via private treaty, avoid the temptation to begin with a lowball bid, otherwise agents will take you less seriously than the buyers who are making serious offers. Make an offer before the auction. If you're buying via auction, get ahead of the competition by making an offer before the auction. If your price matches what the agent expects to get at auction, they might tell their vendor to play it safe and accept your offer. Be flexible around settlement. Tell the agent you're willing to accept different settlement conditions (assuming that’s possible). This might include a short or long settlement, or a scenario in which you let the vendor rent the property for some time before you move in. Despite the rise in inflation and interest rates over the past two years, “nearly all borrowers continue to service their debts on schedule”, according to the latest Financial Stability Review from the Reserve Bank of Australia (RBA). “Households with lower incomes, including many renters, have felt these budget pressures acutely,” the RBA said. “Most mortgagors have experienced an increase in their minimum scheduled payments of 30–60% since the first increase in the cash rate in May 2022. Sharply higher housing costs (for borrowers and renters) and broad-based cost-of-living pressures have weighed heavily on the budgets of many households and contributed to very weak consumer sentiment.” Nevertheless, borrowers have found a way to get by.

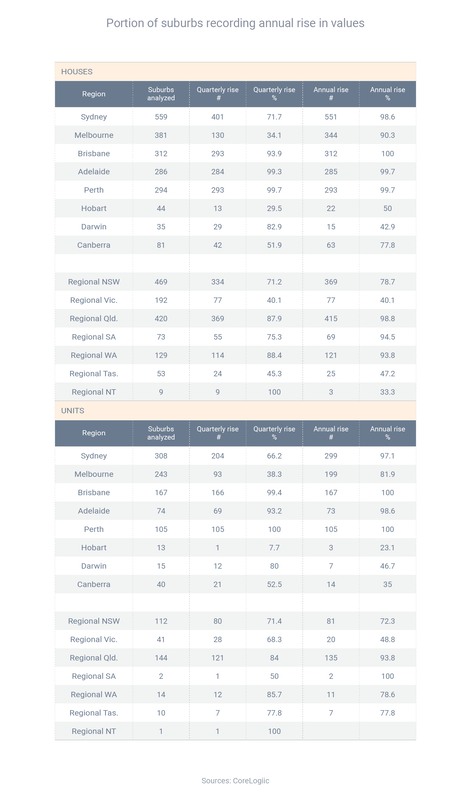

“While housing and personal loan arrears have increased since late 2022, they remain below their pre-pandemic peak,” the RBA said. “At the same time, a small but increasing share of borrowers have requested and received temporary hardship arrangements from their lenders, which has contributed to arrears rates remaining a little lower than would have otherwise been the case.” Australia has hundreds of different property markets, which are often at different points in their cycle, so it's common for there to be many markets where prices are increasing and many where they're decreasing. Right now, though, the vast majority are in growth mode. An analysis of 4,625 house and unit markets around the country by CoreLogic found that 88.4% experienced median price increases over the year to February 2024. That compared to 52.9% in July 2023 and 39.1% in February 2023. CoreLogic economist Kaytlin Ezzy said the reason prices had risen in most markets over the past year was due to an ongoing imbalance between housing supply and demand.

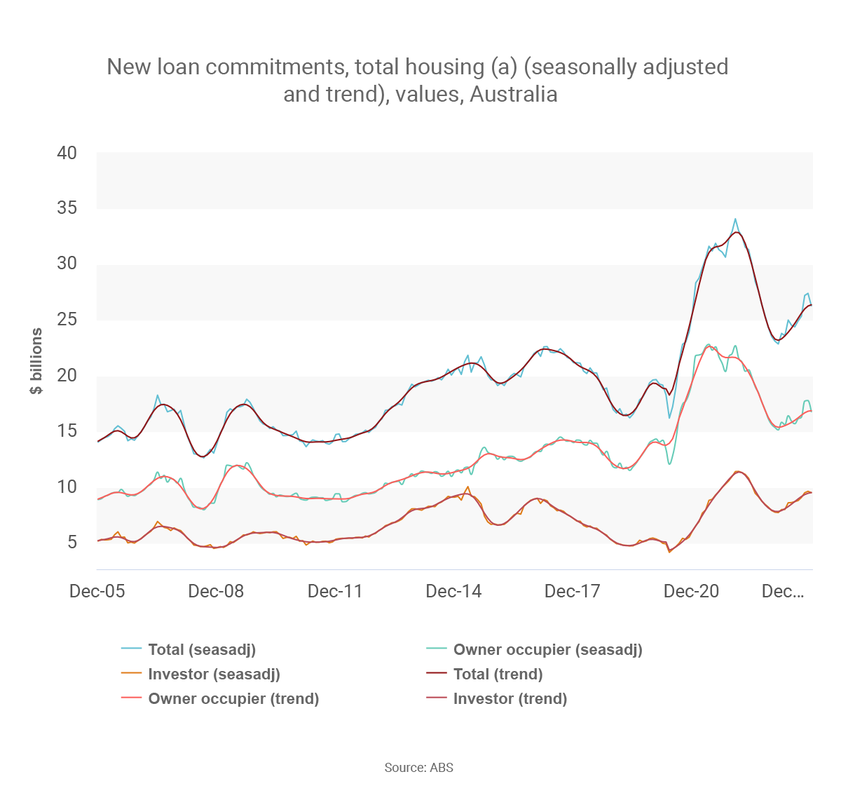

“Despite three rate hikes, worsening affordability, and the rising cost of living, the increasingly entrenched undersupply in housing stock, and above-average demand thanks to strong net migration, has helped push values higher,” she said. The value of new mortgage borrowing is continuing to increase, as more buyers enter the market and property prices – and therefore loan sizes – keep rising. Borrowers committed to $26.40 billion of home loans in February, according to the most recent data from the Australian Bureau of Statistics. That was 1.5% higher than the previous month and 13.3% higher than the previous year. The owner-occupier share was $16.87 billion, which was up 1.6% on the month before and 9.1% on the year before. The investor share was $9.53 billion, which represented a 1.2% month-on-month increase and 21.5% year-on-year increase. But while Australians are taking out more new loans, they’re refinancing fewer existing ones.

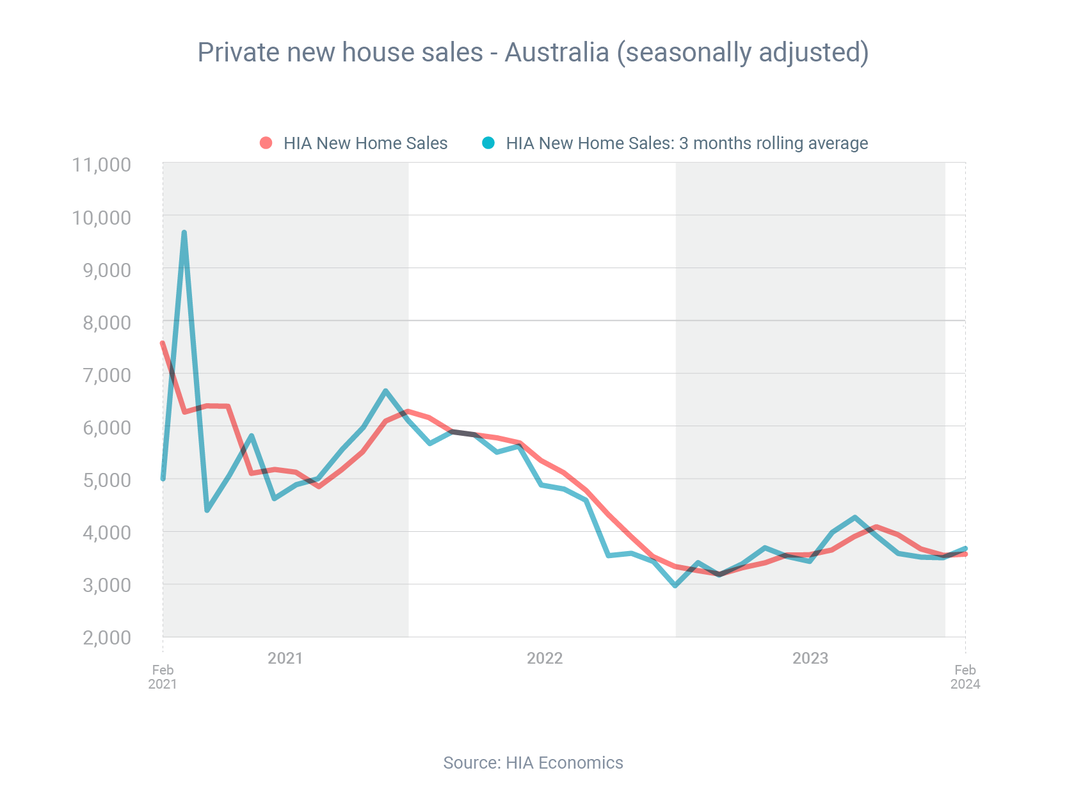

Borrowers refinanced $16.55 billion of loans in February, which was 3.0% higher than the previous month but 17.9% lower than the previous year. Australians purchased 5.3% more new homes in February than the month before, according to the Housing Industry Association (HIA). However, HIA chief economist Tim Reardon said this increase was off a “very low” base. Based on the number of new homes being approved for construction and purchased, he forecast there would be a decade-low amount of homebuilding activity in 2024, despite the pent-up demand for housing. Nevertheless, banks are still keen to lend to Australians who want to build a new home or renovate an existing one. To finance your project, you’ll need a construction loan (rather than a regular home loan). Here’s how construction loans work:

First home buyers are able to enter the market a little faster than a year ago, new research has found. At a national level in February, it took 4 years 9 months for a first home buyer to save a 20% deposit on an entry-level house, compared to 4 years 11 months the year before. For an entry-level unit, the time to save a deposit was 3 years 5 months – one month faster than the year before. Domain classified an entry-level property as one ranked at the 25th price percentile (with the 1st percentile being the cheapest home and the 100th being the dearest). Domain's calculations assumed that first home buyers were a couple aged between 25-34, earning an average salary for someone their age.

The reason that first home buyers are now able to save a deposit more quickly is not because property prices have fallen over the past year – because they've actually increased. Rather, it's because earnings power (through a combination of higher wages and higher savings account interest rates) has grown faster than property prices. New research by the e61 Institute and PropTrack has revealed there's been a significant increase in relative stamp duty costs in recent decades. Back in the early 1980s, buyers in Sydney, Melbourne, Brisbane and Adelaide needed to do about one month's work to cover the cost of stamp duty, assuming they purchased a median-priced property and earned the average post-tax income. But as of 2023, it takes about six months’ work in Sydney and Melbourne, five in Adelaide and four in Brisbane. Last year, almost all buyers faced a stamp duty rate equivalent to at least 3% of the sale price, while, in the early 1990s, almost all buyers paid less than this amount. PropTrack senior economist Angus Moore said the two reasons stamp duty had become relatively more expensive were because property prices had grown faster than incomes and state governments had allowed ‘bracket creep’ to occur with stamp duty tax brackets.

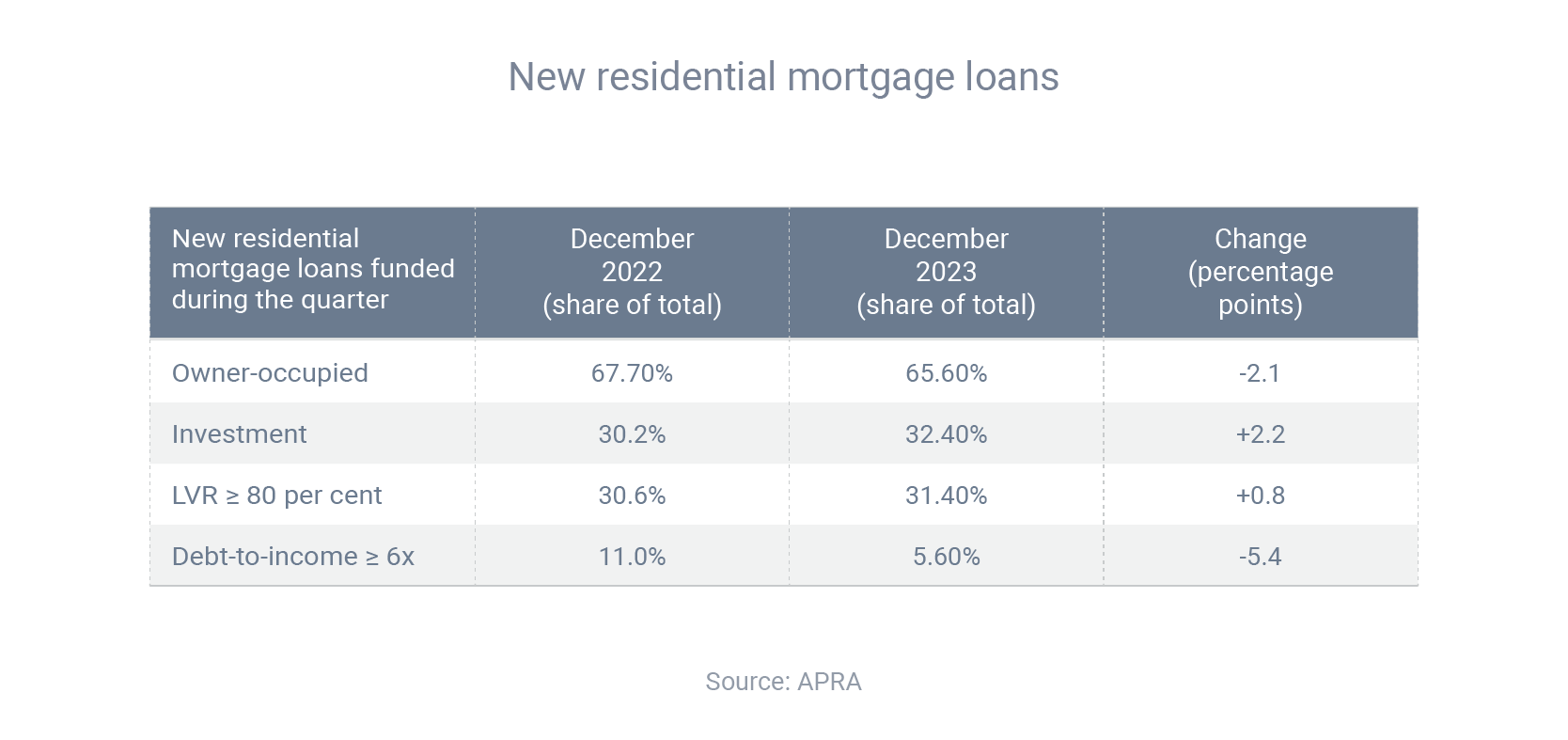

“Bracket creep happens, firstly, because the price brackets have been updated only infrequently and, secondly, because home prices have grown, often substantially, since the brackets were last set,” he said. “That means more properties have moved up the brackets and are now paying higher rates of stamp duty.” The latest tranche of home loans data from the banking regulator, APRA, has revealed three interesting shifts in the mortgage market over the past year. First, there's been a meaningful rise in investor activity during that time. During the December 2022 quarter, 30.2% of new loans were for investment purposes; but in the December 2023 quarter, the share increased to 32.4%. There's been a corresponding decline in owner-occupier activity, which fell from 67.7% to 65.6%.  Second, there's been a sharp decline in borrowing with a debt-to-income of 6 or greater (e.g. someone on a $100,000 salary borrowing $600,000 or more). This fell from a 11.0% share of new loans in December 2022 to only 5.6% in December 2023.

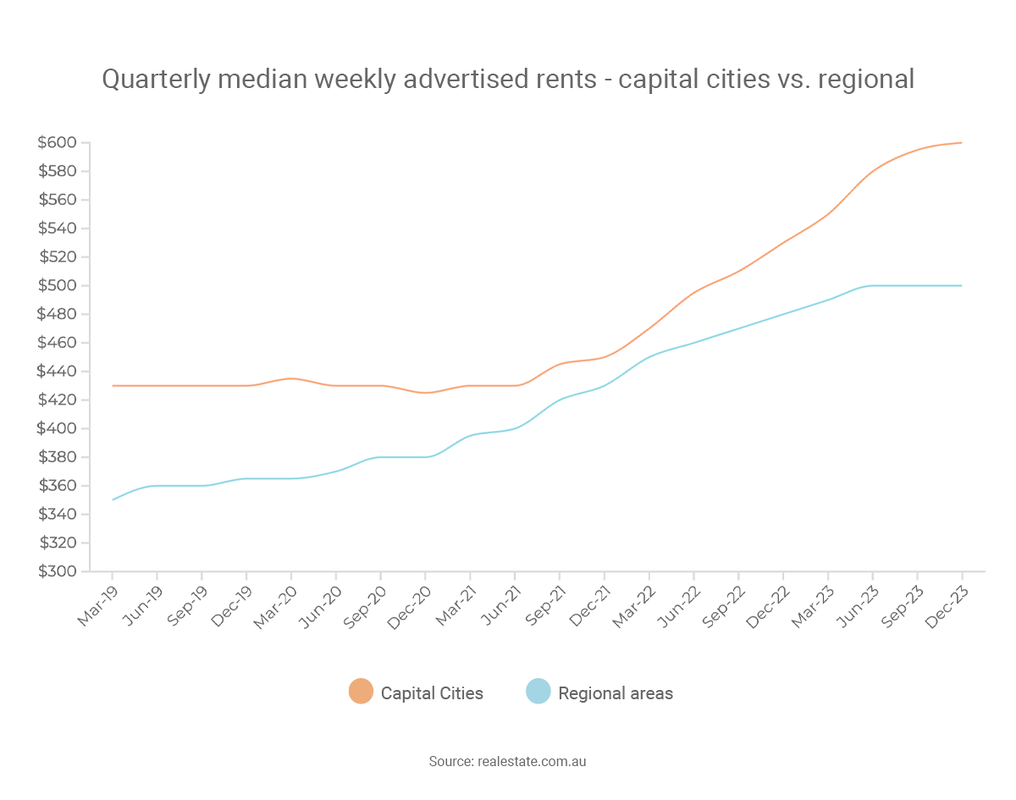

Finally, the share of borrowing with a loan-to-value ratio of 80% or higher has actually increased, from 30.6% of new loans in December 2022 to 31.4% in December 2023. Whether you’re an owner-occupier or investor, I can advise you about your borrowing power and help you get a great home loan. Rents have increased in most capital cities over the past year and are likely to continue rising throughout 2024, according to a leading property data expert. Between the December quarters of 2022 and 2023, the median rent on realestate.com.au rose 11.5%. That included double-digit gains in Perth (20.0%), Melbourne (18.3%), Sydney (16.7%) and Adelaide (12.5%), as well as increases in Brisbane (9.1%) and Darwin (1.7%). By contrast, rents stagnated in Canberra (0.0%) and declined in Hobart (-4.8%). During the same period, the vacancy rate fell from 1.3% to just 1.1%. With rents growing and vacancies falling, this is potentially a good time to be a property investor. PropTrack's director of economic research, Cameron Kusher, forecast that the “tough rental market conditions” would continue.

“We expect supply to remain tight and demand to stay strong, likely pushing rents higher,” he said. “Lending to investors trended higher over 2023, indicating that investors are returning to the housing market. However, many investors continued to sell, resulting in a relatively small pool of rental properties being available for the large number of people seeking accommodation. The rapid increase in Australia’s population exacerbated rental market challenges, as most people migrating to Australia become renters.” A significant number of borrowers are unclear about lender’s mortgage insurance (LMI), according to a recent survey of mortgage brokers by LMI provider Helia.

The survey found that 85% of broker respondents think LMI can benefit buyers who want to get into the market earlier, while 70% believe it can also help renters who want to transition into ownership. However, 50% of respondents feel borrowers generally don't properly understand LMI. LMI is a form of insurance that protects the lender in case the borrower defaults on the mortgage and the lender can't recover the loan from selling the home. The premium varies, depending on the size, type and location of the property. Lenders generally insist borrowers take out LMI if they want to buy a property with less than a 20% deposit – although, for some professions, such as doctors and lawyers, it’s possible to buy a property with a smaller deposit without paying LMI. The upside to using LMI is you can enter the market with a smaller deposit; the downside is the cost. I’d be happy to discuss both the potential benefits and costs, so you can make an informed decision about whether LMI is right for your personal situation. There's been a significant increase in first home buyer activity over the past year, based on the latest data from the Australian Bureau of Statistics. There were a total of 9,491 owner-occupier first home buyer mortgages issued across Australia in December 2023, which was 12.9% higher than the year before. First home buyer activity rose in six of the eight states and territories, with Queensland and Tasmania being the exceptions to the rule. While it can be challenging to buy your first home, this data shows it’s not impossible. Here are four tips to get on the property ladder:

Six things every woman should know about their financial success on International Women’s Day

Planning to succeed is integral, you don’t need to be buying a property to speak with a mortgage broker, it could be part of your plan in years to come, and they can be part of your success planning Knowing where your money goes each month, is integral… there are so many cheap, or free money management tools out there, so start tracking, work out where you can improve your cash flow, and move faster towards your savings / investment / home ownership goals The impact of maternity leave on your retirement strategy in years to come can be enormous. Thinking about how you might counter this impact, through additional super contributions, a more aggressive debt reduction, or savings plan, or having an agreement with your partner that during that time away from the workforce you will supplement your super with additional contributions to not leave you behind in later years, is important to forward plan for. Delegating our chores around the home, so you can focus on your work, career and family, and remain hyper focussed on the things you value, is key where you have big goals - contrary to popular belief, you don’t need to do it all! Assuming you cannot buy a home, without consulting a mortgage broker, would be a big mistake. There are a lot of misconceptions in the community, and asking questions, will help you get to where you want to go faster. Having boundaries to ensure your body, and mind are as best as you can be, is integral to success. Remember, you have to put your face mask on first, before you can help anyone else, and you need to be in the right place, to be a great boss, staff member, parent or friend. Running yourself into the ground, never helped anyone! Many economists believe the Reserve Bank will start cutting interest rates in the final quarter of 2024. So if you're thinking about entering the market, should you buy now or wait for those potential rate cuts to occur? To answer that question, it can be helpful to consult long-term data. During the decade to January 2024, Australia's median property rose 80.1%, according to PropTrack. Prices rose faster in the combined regions than the combined capital cities (92.5% vs 75.7%), while house growth exceeded unit growth (89.4% v 44.4%). But the general trend for all these categories was the same – up. Domain's chief of research & economics, Nicola Powell, believes buyers should take a longer-term view and not get too hung up about how the market is currently performing. “When you’re purchasing a property, it’s for a long-term investment and you are going to ride multiple property cycles, and that’s how you build financial wealth. So if I would give any advice, it would be to buy when it’s right for you. Housing markets are complex and often impossible to predict.”

Ultimately, the question or whether to buy now depends on your personal situation and goals. For some, now will be the right time; for others, it will be better to wait. I'm happy to have a chat and crunch some numbers for you, so I can present personalised loan options for your situation. Becoming a better budgeter can help you save more, invest more and get ahead on your home loan.

To stay on top of your finances, there are two broad approaches you can take. The first is to plan how much you’ll spend on each category (groceries, entertainment, etc) each month. If you stick to your budget, you’ll know in advance how much you’ll save. The second approach is to throw out the budget and focus on saving instead: Decide how much money you want to save each month Set up an auto-transfer to move this amount of money from a transaction account to a savings account whenever your salary gets paid Spend whatever is left in the transaction account, however and whenever you like The first approach suits people who want to pay close attention to their money, while the second is for people who want to ‘set and forget’ their savings. Whichever approach you take, a good place to begin is to review your last 12 months of expenses, to see how much you’re spending and on what things. You can use that information to identify areas of wastage and set savings targets. Australia's median property price reached a record $757,746 at the end of 2023, after another year of growth. The median price rose 3.0% during the pandemic year of 2020, surged 24.5% in 2021, contracted 4.9% in 2022 and then climbed another 8.1% in 2023, according to CoreLogic. The median price for the combined capitals ended 2023 at record levels, while the combined regions were just 1.5% off peak. December was the 11th consecutive month of price gains (see graph) – however, as CoreLogic research director Tim Lawless noted, it was also the smallest of those monthly gains, at 0.4%. “After monthly growth in home values peaked in May at 1.3%, a rate hike in June and another in November, along with persistent cost of living pressures, worsening affordability challenges, rising advertised stock levels and low consumer sentiment, have progressively taken some heat out of the market through the second half of the year,” he said.

As interest rates move up and down, so does the average person's borrowing power. Borrowing power tended to decline in 2023 and is likely to change again in 2024 as rates evolve. The other point worth mentioning is that your borrowing power can vary significantly from lender to lender. The good news is that I can match you with a bank that wants to lend to someone with your situation.  Every state has recorded a rise in property investor borrowing over the past year, with Western Australia leading the way. Throughout Australia, investors took out $9.72 billion of home loans in November 2023, which was 18.0% higher than the year before, according to the most recent data from the Australian Bureau of Statistics. Looking at the individual states, the year-on-year increases in investor borrowing ranged from 3.5% in Victoria to 42.1% in Western Australia. This strong increase in property investor activity might be because investors are enjoying a double wealth gain right now: during 2023, investors enjoyed increases in both the national median property price (by 8.1%) and national median rent (by 8.3%), according to CoreLogic.

One of the key things to remember with investor loans is that your outcomes can vary significantly from lender to lender. Depending on your financial position and the property you want to buy, different lenders will offer you different loan products, loan sizes and interest rates. As your broker, I will compare the market for you and shortlist lenders that suit someone with your specific scenario. The Australian Taxation Office (ATO) has significantly increased its tax take, in part through a focus on large businesses.

Speaking before the Senate Economics Legislation Committee, ATO Commissioner Chris Jordan said the ATO's net collections in the 2022-23 financial year were $576 billion – up $60.6 billion on the previous year. “Rates of corporate tax compliance in Australia continue to set a very high bar for the rest of the world,” he said. “Since the Tax Avoidance Taskforce commenced in 2016, it has helped secure around $28 billion in additional tax revenue from multinational enterprises, large public and private businesses.” Commissioner Jordan said the ATO's decision to target the big end of town helped send a positive message to smaller businesses. “When the community sees large corporates doing the right thing, we know this has a positive influence on attitudes and behaviour to paying tax,” he said. “Small and medium businesses and individual taxpayers contribute significantly to our bottom line.” Commissioner Jordan also said the ATO wanted “to encourage a culture of paying tax on time and in full”, for businesses of all sizes. |

AuthorRachael Bland – Founder & CEO Archives

February 2024

Categories

All

|

|

Privacy | Credit Guide | FAQs | Calculators

T: 0421 73 88 30 | E: [email protected] Credit Representative Number: 427013 | Australian Credit Licence Number: 391237 | MFAA Accredited Credit Advisor 150638 | Copyright © 2019 Get Smart Results Pty Ltd |

Website by Mint Creative Circle

|

RSS Feed

RSS Feed