|

I wanted to take a minute to appreciate and celebrate my birthday here on the blog :)

I had a little cake... looks like the start of a bush fire, but... CAKE!!!!

When the team take my birthday to the next level and surprise me with this!!! ??????

Super happy to be 21.... again!!!

On Monday, 27 July it was announced by NSW Premier Gladys Berejiklian, that from 1 August, the NSW state government will temporarily axe stamp duty for first home buyers purchasing newly built homes that are valued at under $800,000 (up from the previous limit of $650,000).

This is to support approximately 6,000 first home buyers plus boosting the construction industry. This move will surely help in creating jobs amid the COVID-19 crisis. The state government will also raise the threshold for stamp duty on vacant land. The adjustments will last for 12 months and only applies to first home buyers purchasing newly built homes and vacant land. Estimate from the federal government would be approximately 27,000 grants across $10 billion building projects, supporting 140,000 direct jobs and 1,000,000 related jobs. Interested to find out more? Let's have a chat! With the rapid increase in the number of mortgage lenders offering home loans to consumers, the process is even more complicated than in years past. Fortunately, Get Smart Financial is here to help. We have regular contact with a wide variety of lenders, some of whom you may not even know about. Working with us can save you time! Purchasing a property can be a life-changing experience but the home loan application process can be really daunting if you’re new to the process. We can prepare your application on your behalf and mitigate the risks in your request. See below banks for the current turnaround times. Note: Recently updated SLAs are highlighted in Red

If you have any questions, book in a time with me below. Reviewing your lending, particularly in the year that has been thus far could be ideal means to minimize expenses, boost savings, and provide you financial parachute fund at a time of uncertainty such as the current. This could save you some money or even make money, depending on your strategy,and importantly, could help you sleep a little better at night to know that you have your finances under control, and have a contingency plan in place.

Tips: Consider asking what features you really need, and those you perhaps don't which could save you thousands! The official cash rate is at its lowest ever in 60 years and interest rates are at an all-time low. Your current rate may not be the most competitive at this point even if your mortgage is just over two years old. A very slight rate change could trim your monthly repayments instantly, improving your liquidity in these times of financial stress. Banks at this point are competing for customers. A different lender may offer you better features on your loan that you couldn’t get previously, like an offset account, additional repayment and redraw facilities, an interest-only option or a fixed or split-interest option. If your current lender can’t offer you what you want, it's worth looking for mortgage options that do, and at the best possible rate! Shorter loan terms If you have a steady income despite the COVID-19 crisis, this may be the best time to refinance to a lower interest that could pay off your loan faster with the same repayments. With refinancing, you can switch to a mortgage option with a shorter term, maintaining the same repayment amount. Debt consolidation If you're currently juggling a lot of non-mortgage debts, making it hard to pay, manage and track bills and payments, you might want to consider consolidating payments. If you bundle multiple payments into your home loan, you'll have a clearer timeline on when you can be debt-free, plus you might have lower interest rates than other rates like credit card loans. Refinancing costs Despite the benefits, there may be costs involved in refinancing, depending on your loan and lender. Example costs and fees could be exit fees, government charges, or Lenders Mortgage Insurance. It is best to consider getting a piece of advice from a mortgage broker if you plan to refinance. At Get Smart Financial, we can help you with refinancing, so you can save more, and make the odds be in your favor. Book a meeting so we can discuss! With the rapid increase in the number of mortgage lenders offering home loans to consumers, the process is even more complicated than in years past. Fortunately, Get Smart Financial is here to help. We have regular contact with a wide variety of lenders, some of whom you may not even know about. Working with us can save you time! Purchasing a property can be a life-changing experience but the home loan application process can be really daunting if you’re new to the process. We can prepare your application on your behalf and mitigate the risks in your request. See below banks for the current turnaround times. Note: Recently updated SLAs are highlighted in Red

If you have any questions, book in a time with me below. With interest rates at an all-time low, and many lender’s fixed rates lower than their variable options, locking in an interest rate on your home loan to guard against possible future fluctuation may be attractive. However, it pays to know the ins and outs of fixed-rate loans before committing to one.

When purchasing a property, refinancing, or just renegotiating with your current lender, borrowers can generally decide between fixed-interest loans that maintain the same interest rate over a specific period, or variable-rate loans that charge interest according to market rate fluctuations. Fixed-rate loans usually come with a few conditions: borrowers may be restricted to maximum payments during the fixed term and can face hefty break fees for paying off the loan early, selling the property, or switching to variable interest during the fixed-rate period. However, locking in the interest rate on your home loan can offer stability. For those conscious of a budget and who want to take a medium-to-long-term position on a fixed rate, they can protect themselves from the volatility of potential rate movement. Fixed rates are locked in for an amount of time that is prearranged between you and your lender. Some lenders that offer seven-year or 10-year fixed terms, but generally one to five years are the most popular. The three and five-year terms are generally the most popular for customers because a lot can change in that time. Further to this, fixed-rate loans can also be pre-approved. This means that you can apply for the fixed-rate loan before you find the property you want to buy. When you apply for a fixed rate, you can pay a fixed rate lock-in fee also known as a ‘rate lock’, which will, depending on the lender, give you between 60 and 90 days from the time of application to settle the loan at that fixed rate. With some providers, this fixed rate lock in may be free, such as with Adelaide Bank or Macquarie Bank. With other providers, the fee could range between 0.12% of the loan amount or more, or a flat fee of anywhere between $350-$750. If this is an important feature for you, then the cost of the fixed lock in should absolutely be factored into your understanding of what the proposal will cost you all things considered. It will also depend on the lender as to whether the rate lock will be applied on application or approval. It is important to be really clear on this element, to ensure there is no uncertainty. Pre-approval helps you to discern how much money you are likely to have approved on the official application. Knowing that your potential lender will offer a fixed-term, fixed interest loan gives further peace of mind for those borrowers looking to budget precisely rather than be susceptible to rate fluctuations. Borrowers should also consider the possibility of arranging a ‘split’ loan. This option allows you to split your loan between fixed and variable rates – either 50/50 or at some other ratio. This can allow you to ‘lock-in’ a fixed interest rate for up to 5 years on a portion of your loan, while the remainder is on a variable rate which may give you more flexibility when interest rates change and potentially minimize the risks associated with interest rate movements. Also, be aware that at the end of the fixed-rate term, your loan agreement will include information about how the loan will then be managed by the lender, usually to a ‘revert’ variable rate – which may not be the lowest the lender offers. You should be absolutely discussing your plans for your loan with your broker in the lead up to the expiry of your fixed rate, to ensure that you achieve the best possible outcomes! Want to know more about how to finance your property purchase and whether or not you're eligible for pre-approval, or to review your existing lending? Feel free to reach out, book a meeting and let's chat! One big perks of owning an investment property is claiming depreciation, which is the assessed annual decline in the value of fixtures, fittings, and buildings, which you can claim as a tax deduction to reduce your taxable income.

Surprisingly, many property investors are missing out on major tax deductions that can save them so much money in claiming this depreciation. Claiming depreciation is a great way of minimising your tax, to maximise your cash flow return. This is one of the most under utilised claims available to property investors. Generally, there are two types of depreciation available for property investors, depreciation on building allowance and depreciation on plant & equipment. Commonly known as a building write off, building allowance is the deduction on the building structure. On the other hand, plant and equipment is the deduction for removable items within the building itself, such as tools and equipment. A depreciation schedule includes the breakdown of all building allowance costs, plant and equipment costs, the rates and effective lifespan estimate for each item, and a breakdown of how much you can claim at the end of the financial year. There are two methods of a good report, diminishing value method and cost value method, so it gives you different options for claiming depreciation on your assets. The cost in preparing your depreciation report varies depending on the type of property, it's location, size, and all other factors. Tons of notable quantity surveying companies offer a money-back guarantee, so you have nothing to lose and possibly thousands to gain! Still have more questions in claiming depreciation? Book a Zoom meeting so we can chat! The First Home Loan Deposit Scheme is here to assist eligible first home buyers in purchasing a home sooner with a smaller deposit than what was previously required.

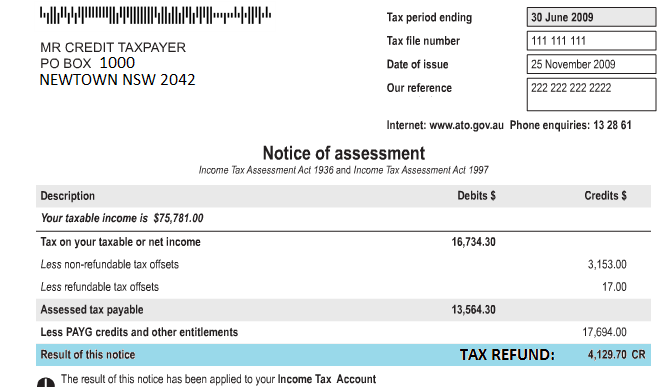

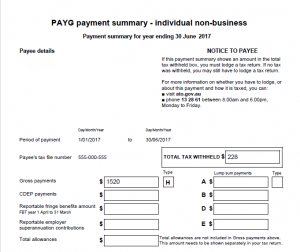

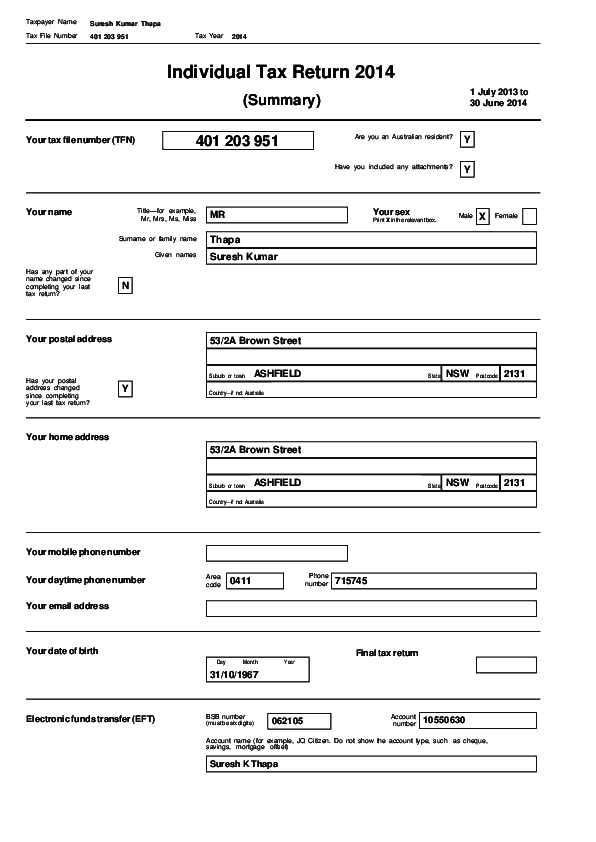

10,000 more opportunities are now available to help Australians buy their first home! It provides a guarantee to participating lenders that allows eligible first home buyers to purchase a home with a little deposit of 5 percent without needing to pay the lenders mortgage insurance for having less than a 20 percent deposit. With the current challenges posed by COVID-19, NHFIC anticipates the continued demand for these new 10,000 places to continue. There are a number of select lenders that have been provided quota for the 10,000 Scheme places for the 2020-2021 financial year, and we can assist by guiding you though your lender options, and their respective process, to achieve the best outcome possible. Applications will require a 2019-2020 Notice of Assessment from the Australian Taxation Office to demonstrate that their taxable income is no more than $125,000 for individuals and $200,000 for couples. You could be in your first home with as little as 5 percent deposit. Want to know more? Hit me up and let's chat! When we are assessing an application for finance, we generally align with the banks and what they request in support documentation in assessing an application for finance. While clients often have ready access to their latest 2 payslips, they sometimes need to go digging a little to find the last 1-2 years of income history for us, being likely what the banks will ask for, and sometimes some confusion as to the difference to a Notice of Assessment, a Payment Summary / Group Certificate, and a Full Tax Return. For context, the difference between the ATO notice of assessment, and the tax return, is that the ATO notice of assessment reflects your taxable income after deductions, not your gross income and the sources it came from. The banks also use the Notice of assessment as proof that what is lodged with your tax return, is in fact what the taxation office actually processed. The full tax return is comprehensive, in providing detail of who you are, where you lived, dependants, health insurance premiums paid, and gross income earned and the businesses earned from. It also details what tax concessions you received, and what tax deductions were claimed. I have attached an example (thanks google!) of each for your reference. The banks will either accept a copy of the PAYG / Group Certificate / Payment summary for the year, OR tax return + ATO notice of assessment. You may be able to download your Payment Summary from here also: https://www.ato.gov.au/individuals/working/working-as-an-employee/accessing-your-payment-summary/ The motivation behind asking for this additional information, is to:

Having trouble to find what we need? Talk to us, let’s work through it together! |

AuthorRachael Bland – Founder & CEO Archives

February 2024

Categories

All

|

|

Privacy | Credit Guide | FAQs | Calculators

T: 0421 73 88 30 | E: [email protected] Credit Representative Number: 427013 | Australian Credit Licence Number: 391237 | MFAA Accredited Credit Advisor 150638 | Copyright © 2019 Get Smart Results Pty Ltd |

Website by Mint Creative Circle

|

RSS Feed

RSS Feed