|

It's 2020, and while I was hoping for a little more hoverboarding aka Marty McFly, a little less pandemic, on the upside technology like Zoom is meaning that I am having a whole lot more fun! Speaking with clients about their dreams and aspirations, helping them run their lending better, and supporting them to plan for the future is actually really cool, and quite the honour and privilege! Yesterday, I had a post settlement meeting with Connie, one of my favourite clients (oh, who am I kidding, I have soooo many favourites!) for a post refinance review. We wanted to make sure that Connie and Patrick have all their banking lined up as we are expecting and have planned, renaming and customising, to ensure that their transition to Macquarie runs as smoothly as possible, and they start achieving the outcomes we set out to achieve, as quickly as possible. What was great about this, is that Connie was at home, as was I.... both working from home now, no travel time was required, nor syncing of other activities to make sure we were in the same place at the same time, and it was fun! And while I would still like to be able to arrive to meetings on my hoverboard, Zoom is not a bad alternative at all, and, there is no risk that I might fall off! Want to check in, see if we can run things a little better for you? The Commonwealth Bank of Australia (CBA) has reminded customers that it will be automatically reducing direct debit repayment amounts for all eligible variable principal and interest (P&I) home loan customers to their minimum repayment required.

The change, which will come into effect from next Friday (1 May), is being made “given the current uncertainty surrounding coronavirus” and as part of the bank’s steps to “continue providing the financial support [CBA] home loan customers need”. As announced as part of its COVID-19 support package last month, CBA said the “one-off change” is aimed at “helping to put a little more cash in the pockets of our customers during these difficult times”, which could be then spent in the economy. Speaking last month, CEO Matt Comyn said the move could help up to 730,000 customers by reducing repayments to the minimum required under their loan contract”, and “release up to $400 per month for customers and create up to $3.6 billion in additional cash support for the economy”. Mr Comyn added: “Our home loan customers are on average 37 months ahead on their home loan repayments. Customers will be able to opt-out after the change is effective should they wish to keep their current repayments.” The bank also revealed that 39 per cent of their home loan customers are more than 12 months ahead of repayments – with the vast proportion of this being two years ahead on their mortgage. CBA said that the changes will take place between 1 and 5 May. Customers wishing to retain or change their current repayments will be able to change their direct debit repayments via the CommBank app or NetBank from 6 May. CBA added: “Please accept our reassurance that the decision was made with the best intentions, though we acknowledge that no one decision can suit everyone.” If you need further information or assistance, you can book a zoom meeting with me. While 2020 is well and truly upon us, it is fair to say that this far in, it is absolutely going to be a year to remember, but it is not all bad, and we are seeing some great outcomes for clients in these challenging times.

The way we are doing business and interacting with clients, has changed dramatically, and for the better, despite the way that the change has evolved and become a necessity. This is Ash and Simone, some of my most lovely clients, who I must admit I am having an absolute blast working with. We did a quick catch up this morning via Zoom, which is great because no one needs to travel, if you really wanted, you could still be wearing your slippers under the desk (I would *cough* never even consider that!), and there is little downtime or planning time required, working out what time works for everyone on what particular day. And, the banks are getting with the program too, meaning that clients that are looking to purchase or finance, can do so, while still being able to social distance..... Many have quickly onboarded the ability to identify via zoom or Skype 'face to face' meetings, docusign for signing both compliance and applications, and may are now allowing loan documents to be signed via docusign for the most part. At Get Smart, we have some really handy processes in place, which make it super easy to provide both statements, data, and make bookings with the team, such as bank statements.com.au, brokerpad, and youcanbook.me, where you can book straight into our calendar, at a time and day that suits you for your zoom meeting! Thinking about your finance and want to have a chat? Need a new loan, or want to review an existing loan? Reach out, shoot us an email, give us a call, or use the link below... while 2020 is challenging, sorting your finance in 2020 has never been easier, and it could save you thousands! In the current market, we have clients looking to save money and secure home loans as fast as possible.

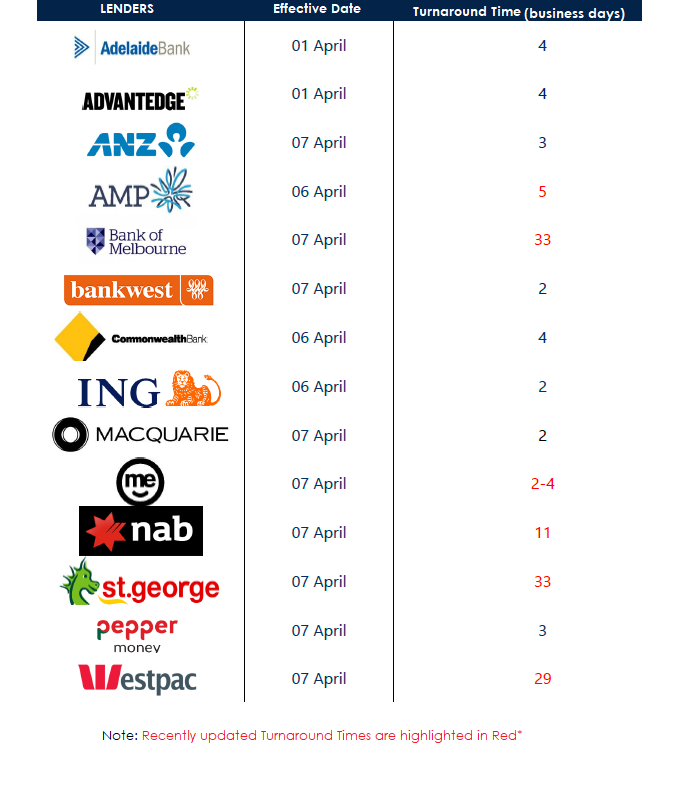

While here at Get Smart, we are considering both what variable and fixed rate options, how much savings and refinance incentive clients can take advantage of; we are also considering turnaround times of the application process. See below banks current turnaround times, that we are factoring into our recommendations with consideration to each and every client’s particular needs! It’s all too easy to rack up debt – credit cards, HECS, car loans – and may seem all too hard to pay it off. Debt can also have a big impact on how much money you can borrow for a home loan, so reducing your debt is essential when you set out to buy your first home.

Here are seven steps you can take towards minimising your debt and moving into the property market. 1. Work out how much you’re spending Create a spreadsheet and track your expenses for a month – record everything so you can see where your money is going. You may be spending much more than you think on some things – more than you can really afford. 2. Decide where you can cut back With a clear idea of how much you spend each month, you can figure out how much you really need to spend, and where you can cut back. That second coffee every day could be costing you $20 a week – that’s $1,000 a year. Buying your lunch rather than bringing it could cost you $2,500 a year. Buying one less bottle of wine a week could save you another $1,200 a year. With a bit of commitment, you can rein in your spending and have more money to repay debt. 3. Make a budget The only way to get on top of your credit cards is to stop using them. Make a budget for the money you need to spend each week or fortnight, based on how much money is coming in and what your necessary expenses are, and stick to it. Calculate how much is left over after you’ve paid for the necessities, then figure out how much you want for discretionary spending and how much you can put towards repaying debt. Also, put money into a contingency fund to cover unexpected expenses such as car repairs that could bust your budget and cause you to reach for the credit card. 4. Prioritise your debt Work out how much money you actually owe on credit cards and loans – you may not realise how much it is. When you know how much debt you’re in, you can think more realistically about repaying it. You need to pay at least the minimum amount due on all credit cards each month to avoid going backwards and in some cases being charged fees and penalties. But by paying only the minimum, you may never get the cards paid off; you need to pay more to make progress. Consider:

5. Make a repayment plan Armed with your budget and having worked out your debt priorities, you can plan which debts you will pay off over what period of time. Having a plan will increase your sense of control over your debt; sticking to it will increase your sense of achievement. 6. Set goals and celebrate them The thought of paying off all your debt may seem daunting, so breaking it down into milestones will help you see the way ahead. Set goals such as paying off 10%, then paying off 25% and so on. Remember to celebrate each time you reach a milestone – buy yourself lunch or go to a movie as a small reward for your achievement. 7. Stick to the plan – and ride out the setbacks Keep going with your repayment plan. If you miss a payment because of an unforeseen expense, stay positive. Avoid feeling demoralised or derailed by looking forward to the next debt milestone – you can get there. |

AuthorRachael Bland – Founder & CEO Archives

February 2024

Categories

All

|

|

Privacy | Credit Guide | FAQs | Calculators

T: 0421 73 88 30 | E: [email protected] Credit Representative Number: 427013 | Australian Credit Licence Number: 391237 | MFAA Accredited Credit Advisor 150638 | Copyright © 2019 Get Smart Results Pty Ltd |

Website by Mint Creative Circle

|

RSS Feed

RSS Feed