|

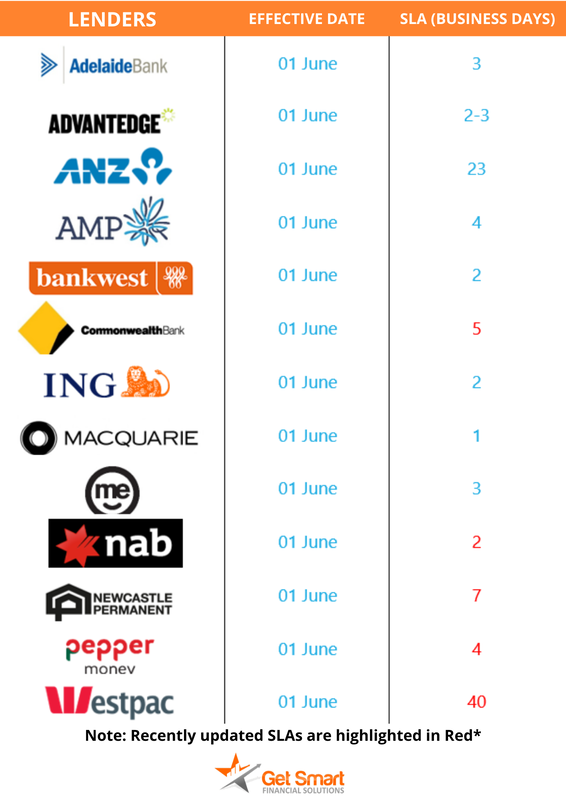

With the rapid increase in the number of mortgage lenders offering home loans to consumers, the process is even more complicated than in years past. Fortunately, Get Smart Financial is here to help. We have regular contact with a wide variety of lenders, some of whom you may not even know about. Working with us can save you time! Purchasing a property can be a life-changing experience but the home loan application process can be really daunting if you’re new to the process. We can prepare your application on your behalf and mitigate the risks in your request. See below banks for the current turnaround times. If you have any questions, book in a time with me below.

Thinking about growing your wealth through property is always the very first step in the process. Entertaining the thought, and wondering if it is possible, however seeing your dreams and goals come to fruition will always require planning, and working with specialists that support that dream and goal. While the property and the related benefits may be the bigger picture goal, The logistics need to be considered, such as where the deposit will come from (equity, or savings?), and what needs to occur in order to pass the bank's loan assessment, in order to obtain the finance. So, with lots of moving parts, and elements to understand, best you get into the driver's seat with having us look at what you need to do in order to occur your dreams! So, some steps, to get you thinking! Step 1: Speak with a Mortgage Broker When considering an investment property, your first port of call should always be your mortgage broker. We will review your assets and liabilities to determine how much you can borrow, which will, in turn, give you a general idea of your target price range, so you can narrow your property search within your purchase budget. Step 2: Budgeting Just like buying your first home, when purchasing an investment property, it’s essential to budget. If you’re unsure of the best way to budget for an investment property, speak with your mortgage broker to help you to get on the right path. Step 3: Important conversations Your broker will discuss your plans and your circumstances with you to determine what you can afford. Your broker will also provide statutory documentation to initiate the lending process and discuss with you what loan products will be appropriate to your specific circumstances, based on your goals and objectives. Want to know more? There is so much to know, and understand.... want to get into the drivers seat and take control of your financial future? Let's have a chat to find out more! Amidst the roller coaster ride of 2020, we reached a silver lining. The Australian government announced HomeBuilder: a $700M housing package for Australians to access $25k grants for building a new home or substantially renovate an existing home. This is available to eligible owner-occupiers including first home buyers and is a time-limited, tax-free grant program to help the residential construction market to get through the Coronavirus pandemic by encouraging the building of a new home and renovations this year. HomeBuilder is available for building contracts signed between 4 June 2020 and 31 December 2020, where construction or renovation commences within three months of the contract date. Owner-occupiers must meet the following eligibility criteria:

If you want to know if you meet the eligibility requirements or just want to know more about the HomeBuilder grant, book a Zoom meeting for us to discuss! With the rapid increase in the number of mortgage lenders offering home loans to consumers, the process is even more complicated than in years past. Fortunately, Get Smart Financial is here to help. We have regular contact with a wide variety of lenders, some of whom you may not even know about. Working with us can save you time! Purchasing a property can be a life-changing experience but the home loan application process can be really daunting if you’re new to the process. We can prepare your application on your behalf and mitigate the risks in your request. See below banks for the current turnaround times. If you have any questions, book in a time with me below. How debt impacts your home loan application

Almost everyone has a debt of some sort - whether it be paying off a student loan (HECS or HELP debt), tax debt, credit cards, personal loans, car loans, or an existing home loan. These debts can affect your proposed home loan application not only impacting your borrowing capacity, but also what type of product you are offered by the bank, depending on your repayment history. A lender will factor in your need to continue to service or meet this regular repayment obligation, in assessing your borrowing capacity or to determine your ability to service a new loan. Further, your repayment history on your existing debts plus the number of times you've applied for credit will affect your credit score. Your credit score will be a guide for lenders to examine how responsible you are with money and to qualify for a home loan. If you have a lot of unsecured credit, then this can be interpreted by a bank as a potential that the client is living beyond their means, and care must be taken to ensure that this discussion is managed carefully. Often we will see clients having taken up a number of credit cards, to take advantage of Award point offers for travel redemption or the like, without understanding the potential implication to their Credit Score or borrowing capacity. Personal loans Whether secured or unsecured, a bank or lender will consider repayments you have to make on personal loans. Same with home loans, they may factor in a buffer on your monthly repayments to stress test the repayment, should the interest rate change. Student loans Any outstanding debt like HECS debt may affect your loan application because it impacts the amount of money coming into your account each month. If you happen to have one, you'll need to start repaying HECS debt once your income reaches a certain threshold that's currently $45,881 a year, and the repayment is based on a percentage of your earnings, depending on what your annual gross earnings are. You can find out more about HECS debt repayment obligations here. Existing mortgage or home loan The first thing a lender will want to know is whether you plan on keeping that existing loan or discharging it. If you plan to discharge the loan, the lender will not factor in the cost of those repayments each month in assessing you for your proposed new loan. If you plan on keeping your existing loan, the bank will factor your need to keep paying the loan into your calculated borrowing capacity - this may or may not impact your application. The lender will also include your ability to service any loans over your investment properties (and include a proportion of the rental income you receive, as well as some tax benefits). Car loans A lender will factor in your car loan repayments. Even if you took out that loan with another person, a lender may treat the debt as it's entirely yours thus reducing your borrowing capacity, or they may split the loan proportionately, depending on that specific bank’s policy around the same. If you have a novated lease over your vehicle, it will likely come out of your pre-tax and possibly also your post-tax income and reduce the amount of money in your pocket each month. This would also need to be considered as an ongoing liability. As a general rule, if you have a car loan of $30,000, then it is likely that this monthly obligation will reduce your borrowing capacity for lending for residential purposes, by approximately $150,000. Careful discussion should be taken before applying for vehicle finance, and considered within the scope of what you are looking to achieve within property and property lending for the coming 5 years, given the potential implications. It is imperative you speak with a finance specialist to ensure that you are planning and mitigating any potential issues. Credit cards have a major impact on your home loan Lenders are less interested in how much you owe, and rather more focused on how much you can possibly owe! They're generally more interested in the credit limits than your credit card balance. The best practice for this is to consolidate your debts or reduce multiple credit cards. Consider closing some cards down, reducing the credit limit of any cards you keep, or consolidate your debts into your new home loan. It is notable that most banks will assume that your monthly repayment to a credit card, is between 3% and 4% of the limit of the card. If you have a credit card with a limit of $20,000 and the bank assumes a 3.5% repayment obligation if you were to max out that facility, then the monthly repayment could be around $700 per month. $700 per month, is equal to around $100,000 in residential finance borrowing capacity, so credit card limits can have a major impact on your borrowing capacity. Building your Credit Score Over the years, I have had so many discussions with clients, who think they should apply for a credit card, a personal loan, or a car loan, to build a credit score, but the complete opposite is true and this is an Urban Myth! For every application for unsecured credit or finance, your credit score is diminished, not improved. So, before you apply for credit to build a credit history, please speak with us. The truth is, you are far better off to put your effort into creating a savings history instead. Last but not least… A lender will always look at your income, your ability to service a loan, and your credit score. Any other loans could affect all three. Before applying for a home loan, make sure you talk to us, so that we can support and guide you towards planning and achieving the outcomes you want and need! Let's have a chat to discuss options on how we can help you save more! Rate remains at record low after implementing the extraordinary mid-month rate cut in March 2020.

The Reserve Bank of Australia has left the official cash rate untouched for this month remaining at the record low rate of 0.25% as the bank commits to monitoring the state of the Australian economy. Home owners possible cash grants Most economic policies of the Federal Government are being reviewed including the possibility of cash grants to home-owners and first home-buyers. These grants are designed to prop up the businesses of tradespeople and help the building and housing construction industry. This week, the government’s fourth stimulus package is expected to be signed off by the national cabinet’s expenditure review committee. Here’s the expected conditions:

The full details will be announced in the coming week. Once we know the specifics, feel free to call us about any questions you may have. If you need further information or assistance, you can book a zoom meeting with me. With the rapid increase in the number of mortgage lenders offering home loans to consumers, the process is even more complicated than in years past. Fortunately, Get Smart Financial is here to help. We have regular contact with a wide variety of lenders, some of whom you may not even know about. Working with us can save you time! Purchasing a property can be a life-changing experience but the home loan application process can be really daunting if you’re new to the process. We can prepare your application on your behalf and mitigate the risks in your request. See below banks for the current turnaround times. If you have any questions, book in a time with me below.

|

AuthorRachael Bland – Founder & CEO Archives

February 2024

Categories

All

|

|

Privacy | Credit Guide | FAQs | Calculators

T: 0421 73 88 30 | E: [email protected] Credit Representative Number: 427013 | Australian Credit Licence Number: 391237 | MFAA Accredited Credit Advisor 150638 | Copyright © 2019 Get Smart Results Pty Ltd |

Website by Mint Creative Circle

|

RSS Feed

RSS Feed