|

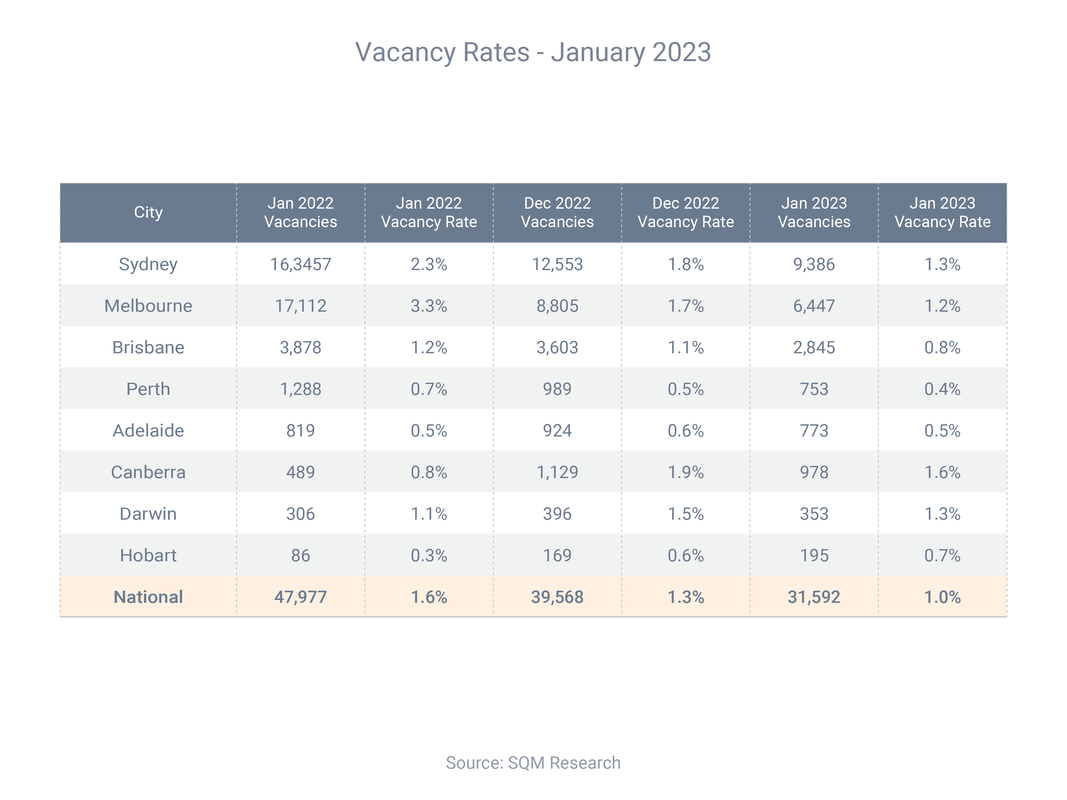

The rental market has turned decisively in favour of property investors, with the number of vacant rental properties plummeting by one-third over a 12-month period. Between January of 2022 and 2023, the number of rental vacancies across Australia fell from 47,977 to 31,592, a reduction of 34.2%, according to SQM Research. At the same time, the vacancy rate – which measures the share of untenanted rental properties – fell from an already-low 1.6% to just 1.0%.

Vacancy rates differ from city to city, but are low throughout the country, ranging from 0.4% in Perth to 1.6% in Canberra. SQM Research managing director Louis Christopher said low vacancy rates were contributing to a “surge in rents”, which in turn was pushing up rental yields. “I believe would-be investors will be attracted to higher rental yields in later 2023, provided the cash rate peaks at below 4% [it's currently 3.35%],” he said

0 Comments

Despite the recent housing downturn, property prices are higher in most parts of the country than before the pandemic. As a result, deposit requirements are higher. Domain compared property prices in the December quarters of 2019 and 2022, and found that buyers needed tens of thousands of dollars more today if they wanted to buy a house and put down a 20% deposit. The increase in 20% house deposits for our four biggest cities was:

While the deposit barrier is high, it’s not insurmountable.

As an expert mortgage broker, I can potentially help you enter the market with a low-deposit loan. Generally, if your deposit is lower than 20%, you will need to pay lender’s mortgage insurance (which can be added to your loan). While it’s never nice to pay an added fee, it can be money well spent if it lets you buy a property several years ahead of schedule |

AuthorRachael Bland – Founder & CEO Archives

February 2024

Categories

All

|

|

Privacy | Credit Guide | FAQs | Calculators

T: 0421 73 88 30 | E: [email protected] Credit Representative Number: 427013 | Australian Credit Licence Number: 391237 | MFAA Accredited Credit Advisor 150638 | Copyright © 2019 Get Smart Results Pty Ltd |

Website by Mint Creative Circle

|

RSS Feed

RSS Feed