|

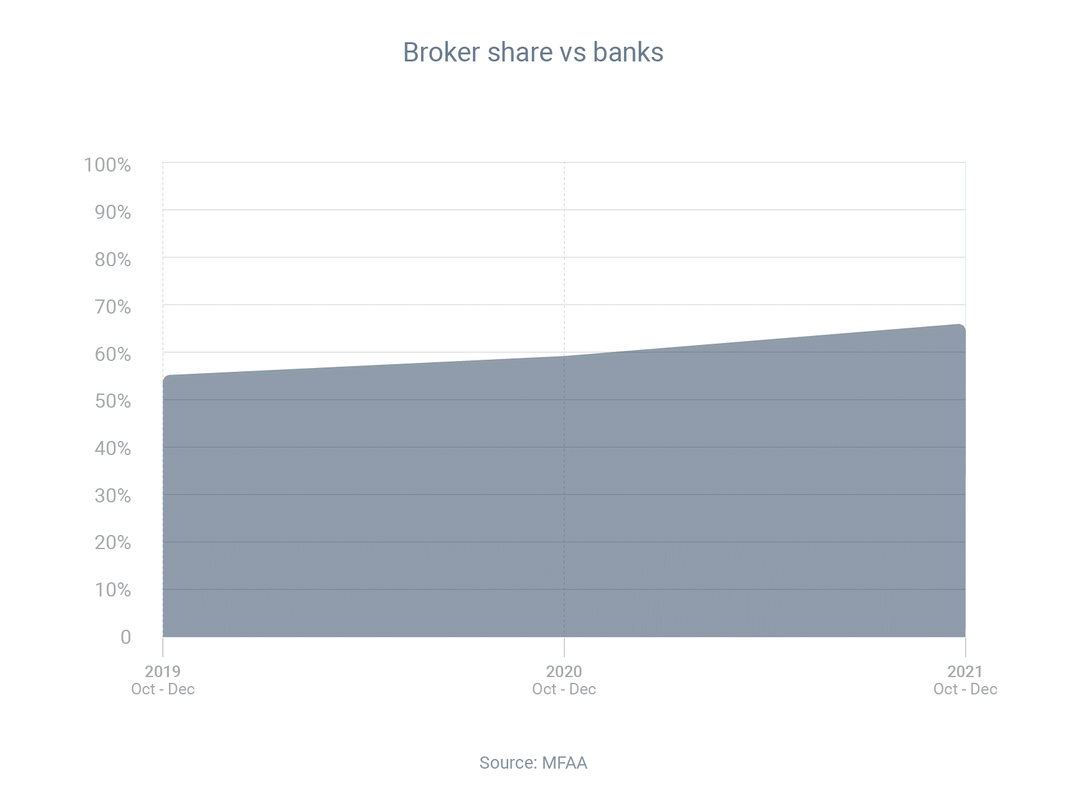

Mortgage brokers were responsible for 66.5% of all new home loans in the December quarter, according to the latest data from research group Comparator. That is not only a record for a December quarter, it's also a significant increase on the market share brokers recorded in December 2020 (59.4%) and December 2019 (55.3%). Mike Felton, the CEO of the Mortgage & Finance Association of Australia, said the strong increase in mortgage broker market share shows that consumers really value the service, competition and choice that brokers provide.

When you visit a bank for home loan advice, the bank will only tell you about its own products, even if it knows another lender is offering a better home loan. But when you visit a broker, the broker will compare interest rates, loan features and borrowing criteria from a range of lenders. The broker will also negotiate with lenders on your behalf. That significantly increases your chances of getting a great loan that’s tailored to your unique circumstances. When it comes to classifying debt as either ‘good’ or ‘bad’, borrowing to fund your education or buy a property are generally regarded as good debt, because both tend to deliver a return on investment.

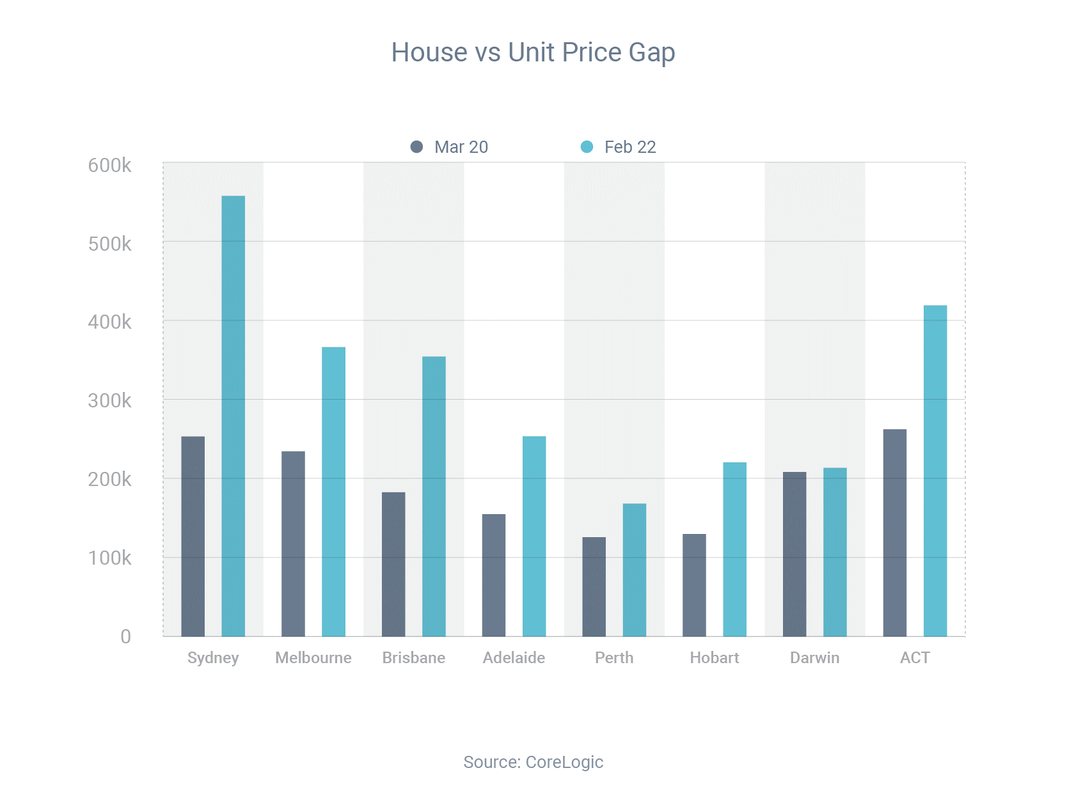

However, you might not realise that taking on HECS-HELP debt can make it harder to qualify for a home loan and reduce your borrowing capacity. That’s because, if hundreds of dollars per month are being diverted from your salary to repay your student debt, that means you have less money to devote to mortgage repayments. So does that mean you should repay your HECS-HELP loan as soon as possible? Maybe yes, maybe no. On the one hand, eliminating your student debt could make it easier to get a home loan. On the other hand, student debt is interest-free (although it does increase in line with inflation), so it might be better to repay other interest-incurring loans first. Give me a call if you want to know the best approach for your situation or your child’s situation. Buying a typical house will now cost you almost 30% more than buying the typical unit. CoreLogic has reported that, at the end of February, Australia's median house price was 29.8% higher than its median unit price – a record gap. To put it in dollar terms, median prices are $791,400 for houses and $609,800 for units, which means the gap is almost $182,000.

That gap has significantly widened in the past two years:

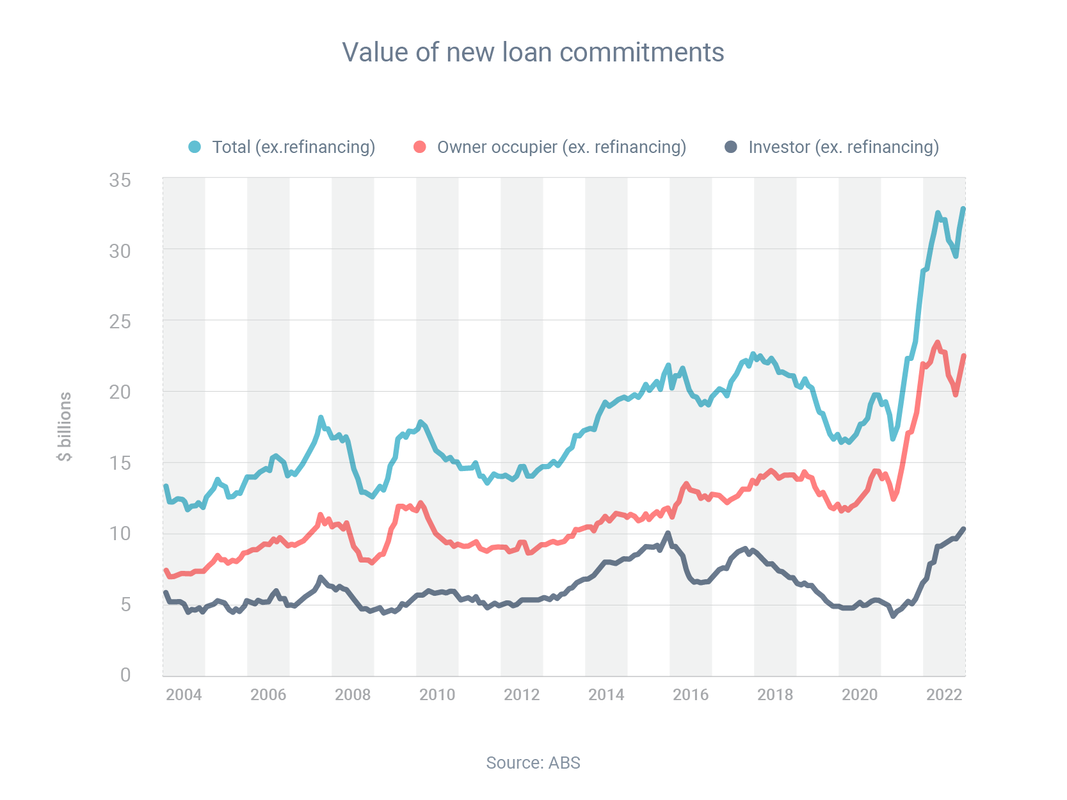

On the other hand, it’s also possible the gap will narrow, because with houses looking relatively dear and units relatively cheap, demand might shift from the former to the latter. The official data confirms what you might’ve heard anecdotally – property investors are very active right now. Property investors took out $33.7 billion of home loans in January, according to the Australian Bureau of Statistics, marking the second consecutive month in which investors set a borrowing record. To illustrate how investment activity has surged in recent times, investors borrowed 67.8% more in January than the year before.

This increase has occurred throughout the country, with investment activity increasing by:

That means most property investors are finding it easy to secure quality tenants. It also gives many investors the chance to raise rents, because demand for rental accommodation is so high right now. |

AuthorRachael Bland – Founder & CEO Archives

February 2024

Categories

All

|

|

Privacy | Credit Guide | FAQs | Calculators

T: 0421 73 88 30 | E: [email protected] Credit Representative Number: 427013 | Australian Credit Licence Number: 391237 | MFAA Accredited Credit Advisor 150638 | Copyright © 2019 Get Smart Results Pty Ltd |

Website by Mint Creative Circle

|

RSS Feed

RSS Feed