|

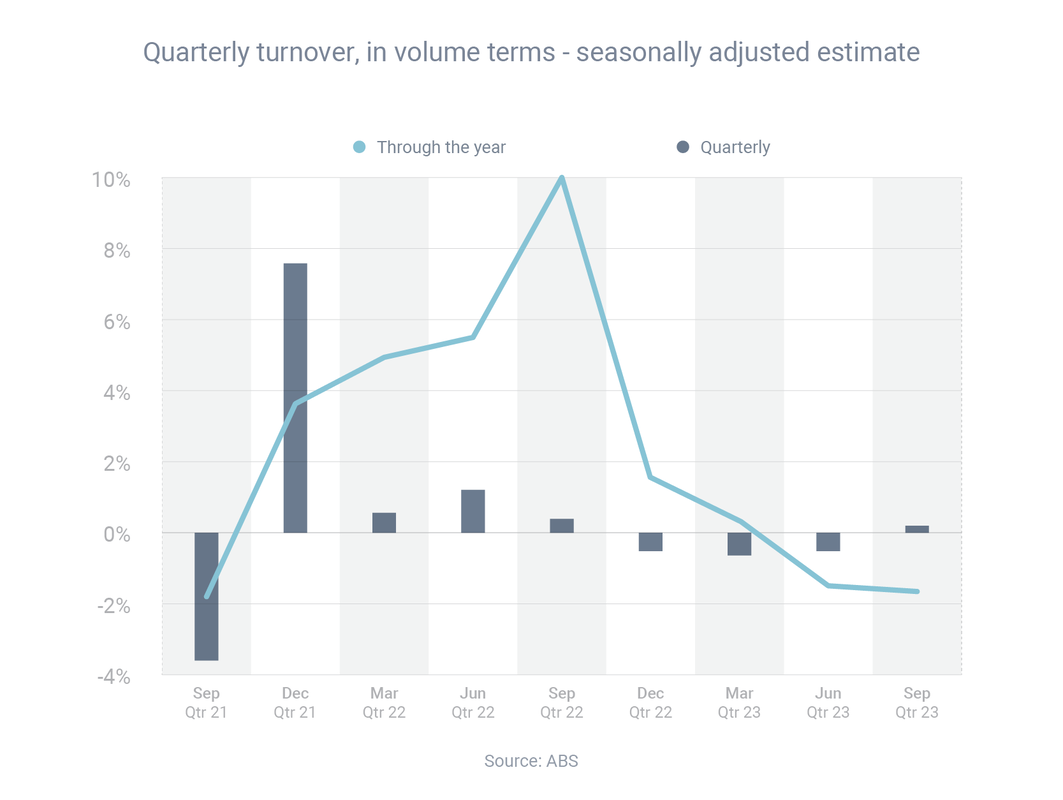

Retail turnover has now increased for three consecutive months, but sales remain at low levels as consumers think twice before spending. Turnover rose 0.9% in September, after previously increasing 0.3% in August and 0.6% in July, according to the Australian Bureau of Statistics (ABS). “The warmer-than-usual start to spring lifted turnover at department stores, household goods and clothing retailers, with more spending on hardware, gardening, and clothing items. Also adding a boost to turnover in household goods retailing was the release of a new iPhone model and the introduction of the Climate Smart Energy Savers Rebate program in Queensland,” ABS Head of Retail Statistics Ben Dorber said. However, he also said that “subdued spending for most of 2023 means that underlying growth in retail turnover remains historically low”.

Retail turnover in September was only 2.0% higher year-on-year. Looking at the different retail categories, the change in turnover was:

The Australian Taxation Office (ATO) has noticed a spike in businesses reporting but not remitting GST, ATO Deputy Commissioner Hector Thompson said in a speech to The Tax Institute's national GST conference.

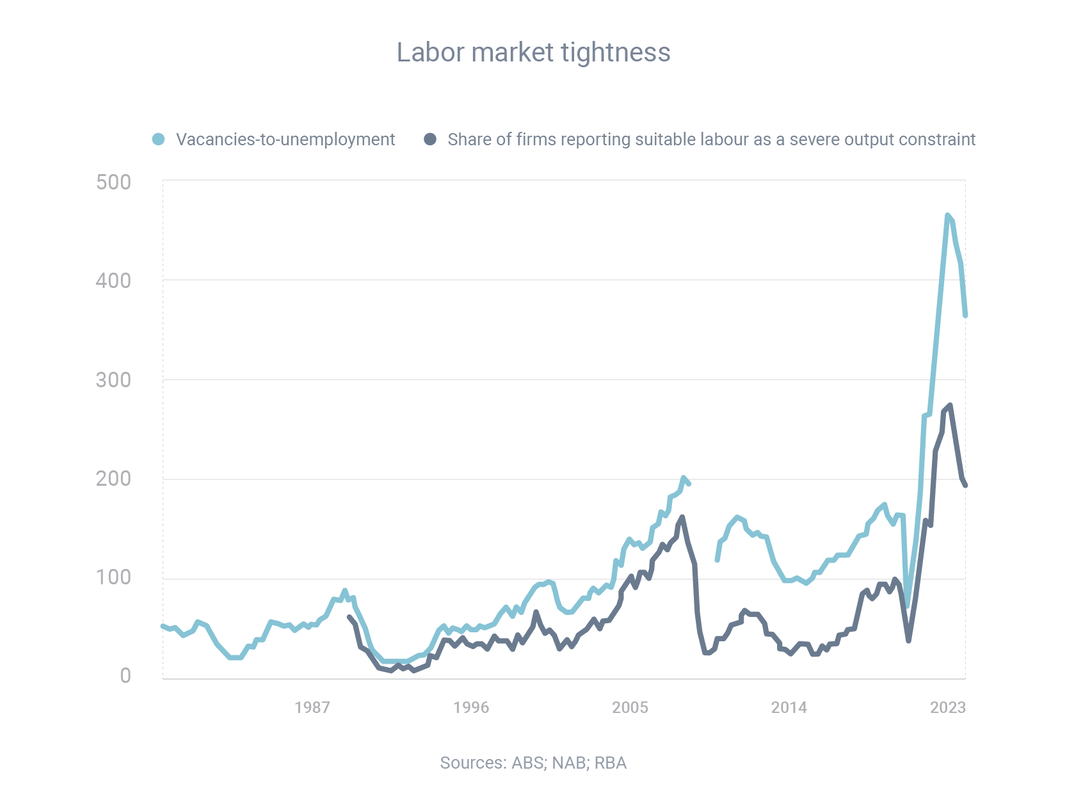

As a result, GST debt more than doubled in the three years to 30 June 2022. “While this increase in debt has been experienced across all taxes the ATO administers, GST debt is growing the fastest. We understand that recent times have been challenging and there will be more challenges ahead. However, reporting, but not remitting GST creates an uneven playing field for businesses that do remit the GST,” he said. Deputy Commissioner Thompson said the ATO was introducing a program to provide accountants with information about potential GST risks. “Over the next four years, we will undertake early intervention engagement activities with registered tax agents who may have clients that exhibit potential GST-related risks. The aim of the program is to educate and leverage agents’ relationships with their clients to positively influence their behaviours and ensure compliance with regulations,” he said. “We will deliver risk alerts to some tax agents providing a view of potential risks in their client base. The intention here is to encourage agents to review their processes and interactions with their clients, and take corrective action, where appropriate.” Broad measures of labour underutilisation have increased over the course of the year as the economy has slowed, according to the latest Statement of Monetary Policy from the Reserve Bank of Australia (RBA). Nevertheless, the job market remains strong, which means the data is giving mixed signals:

As a result, the labour market remains tight and “finding suitable workers continues to be difficult” for businesses.

One interesting trend the RBA has observed is a change in the nature of how businesses are choosing to employ people. “Employment growth has increasingly been driven by part-time employment in recent months. This contrasts to patterns observed during the recovery from the pandemic, when full-time employment accounted for almost all employment growth. Relatedly, average hours worked have declined a little recently and are expected to remain a key margin of adjustment as labour demand eases further,” the RBA said. NAB Monetary Policy Update: RBA to Hold Rates Until Late 2024, Cuts Expected in 2025

Key Points:

Softer Inflation Eases Pressure on RBA:

Outlook for Growth and Labor Market:

Risks and Uncertainties:

Overall, NAB's revised forecast suggests a period of stability in interest rates before potential cuts in late 2024, with the RBA focusing on balancing inflation and labor market concerns. |

AuthorRachael Bland – Founder & CEO Archives

February 2024

Categories

All

|

|

Privacy | Credit Guide | FAQs | Calculators

T: 0421 73 88 30 | E: [email protected] Credit Representative Number: 427013 | Australian Credit Licence Number: 391237 | MFAA Accredited Credit Advisor 150638 | Copyright © 2019 Get Smart Results Pty Ltd |

Website by Mint Creative Circle

|

RSS Feed

RSS Feed