|

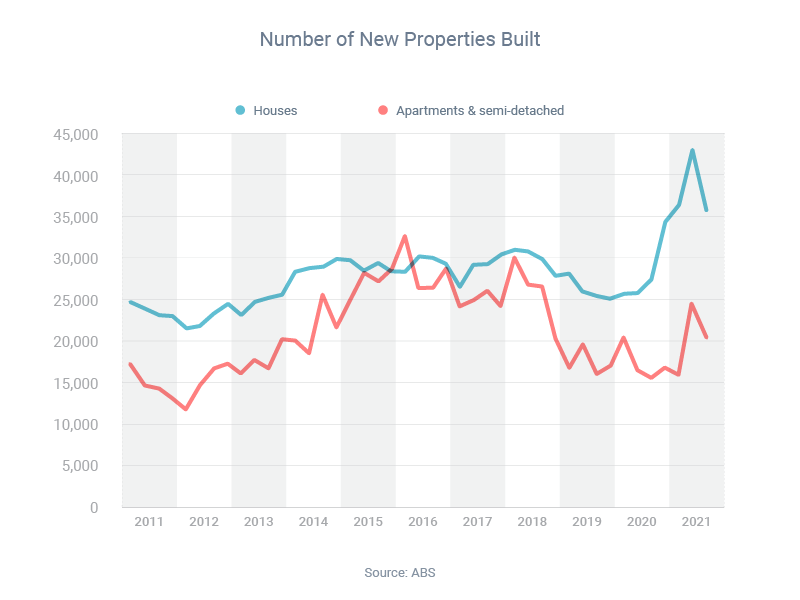

There's a house building boom going on right now, partly because of the now-concluded HomeBuilder incentive and partly because interest rates are so low. Building work started on a record 149,345 new detached houses in the year to September 2021, according to the latest data from the Australian Bureau of Statistics. If you’re planning to build a new home, please note that financing residential construction projects is more complicated than getting a standard home loan.

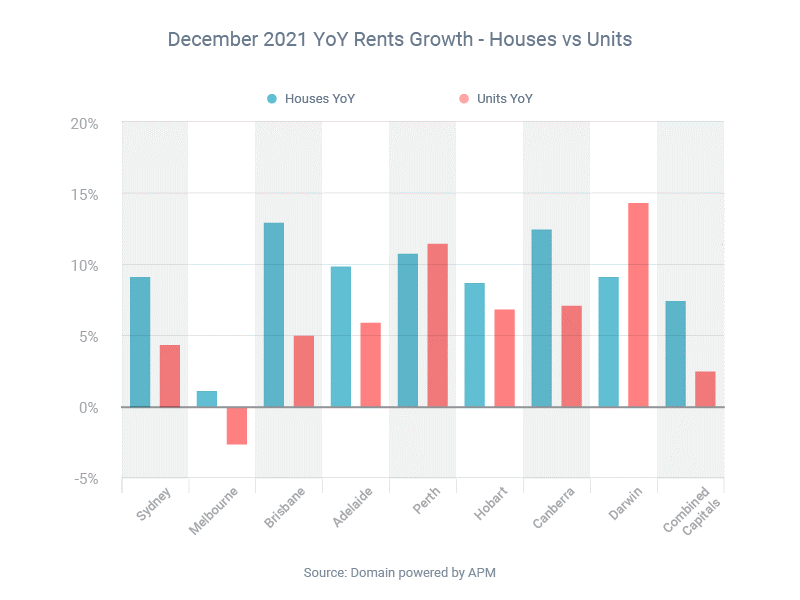

Lenders require more paperwork – all the usual documents, plus a copy of your building contract, building plans and building specifications, as well as quotes for any additional work you might be planning. The way lenders pay out the loan is also more complicated: instead of giving the money in one lump sum, they distribute it in five ‘drawdowns’ as the build reaches key milestones. If you want to build a new home in 2022, give me a call – I can talk you through your options With rents climbing steeply in many parts of the country, 2022 might be the ideal time for younger Australians to enter the market. The average rent paid by a tenant living in a capital city was 7.4% higher in the December quarter of 2021 than the same quarter of 2020, according to Domain. So if you’re a first home buyer, you might be wondering – what can you do to save a deposit? Options include:

Home loan activity is at historically high levels, according to the latest data from the Australian Bureau of Statistics. Australians committed to $31.4 billion of home loans in November, which was 6.3% higher than the previous month and 33.2% higher than the previous year. Owner-occupier borrowing was up 7.6% on the month and 17.2% on the year, while investor borrowing was up 3.8% on the month and 86.9% on the year. Want to enter the market this year? Here are three home loan tips:

|

AuthorRachael Bland – Founder & CEO Archives

February 2024

Categories

All

|

|

Privacy | Credit Guide | FAQs | Calculators

T: 0421 73 88 30 | E: [email protected] Credit Representative Number: 427013 | Australian Credit Licence Number: 391237 | MFAA Accredited Credit Advisor 150638 | Copyright © 2019 Get Smart Results Pty Ltd |

Website by Mint Creative Circle

|

RSS Feed

RSS Feed