|

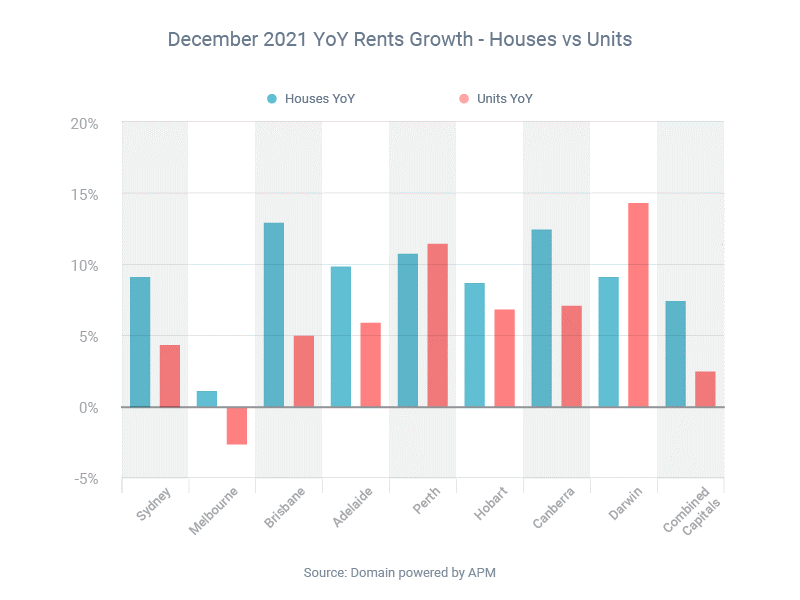

With rents climbing steeply in many parts of the country, 2022 might be the ideal time for younger Australians to enter the market. The average rent paid by a tenant living in a capital city was 7.4% higher in the December quarter of 2021 than the same quarter of 2020, according to Domain. So if you’re a first home buyer, you might be wondering – what can you do to save a deposit? Options include:

Comments are closed.

|

AuthorRachael Bland – Founder & CEO Archives

February 2024

Categories

All

|

|

Privacy | Credit Guide | FAQs | Calculators

T: 0421 73 88 30 | E: [email protected] Credit Representative Number: 427013 | Australian Credit Licence Number: 391237 | MFAA Accredited Credit Advisor 150638 | Copyright © 2019 Get Smart Results Pty Ltd |

Website by Mint Creative Circle

|

RSS Feed

RSS Feed