|

Becoming a better budgeter can help you save more, invest more and get ahead on your home loan.

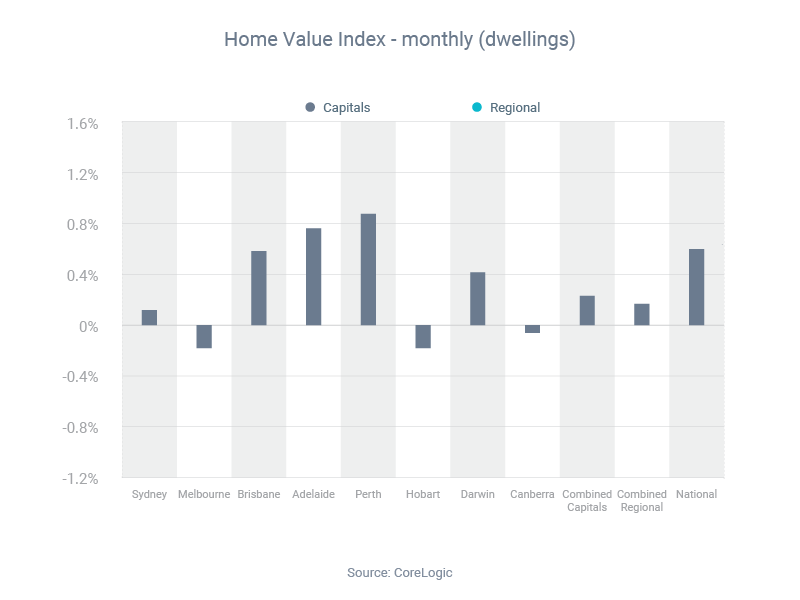

To stay on top of your finances, there are two broad approaches you can take. The first is to plan how much you’ll spend on each category (groceries, entertainment, etc) each month. If you stick to your budget, you’ll know in advance how much you’ll save. The second approach is to throw out the budget and focus on saving instead: Decide how much money you want to save each month Set up an auto-transfer to move this amount of money from a transaction account to a savings account whenever your salary gets paid Spend whatever is left in the transaction account, however and whenever you like The first approach suits people who want to pay close attention to their money, while the second is for people who want to ‘set and forget’ their savings. Whichever approach you take, a good place to begin is to review your last 12 months of expenses, to see how much you’re spending and on what things. You can use that information to identify areas of wastage and set savings targets. Australia's median property price reached a record $757,746 at the end of 2023, after another year of growth. The median price rose 3.0% during the pandemic year of 2020, surged 24.5% in 2021, contracted 4.9% in 2022 and then climbed another 8.1% in 2023, according to CoreLogic. The median price for the combined capitals ended 2023 at record levels, while the combined regions were just 1.5% off peak. December was the 11th consecutive month of price gains (see graph) – however, as CoreLogic research director Tim Lawless noted, it was also the smallest of those monthly gains, at 0.4%. “After monthly growth in home values peaked in May at 1.3%, a rate hike in June and another in November, along with persistent cost of living pressures, worsening affordability challenges, rising advertised stock levels and low consumer sentiment, have progressively taken some heat out of the market through the second half of the year,” he said.

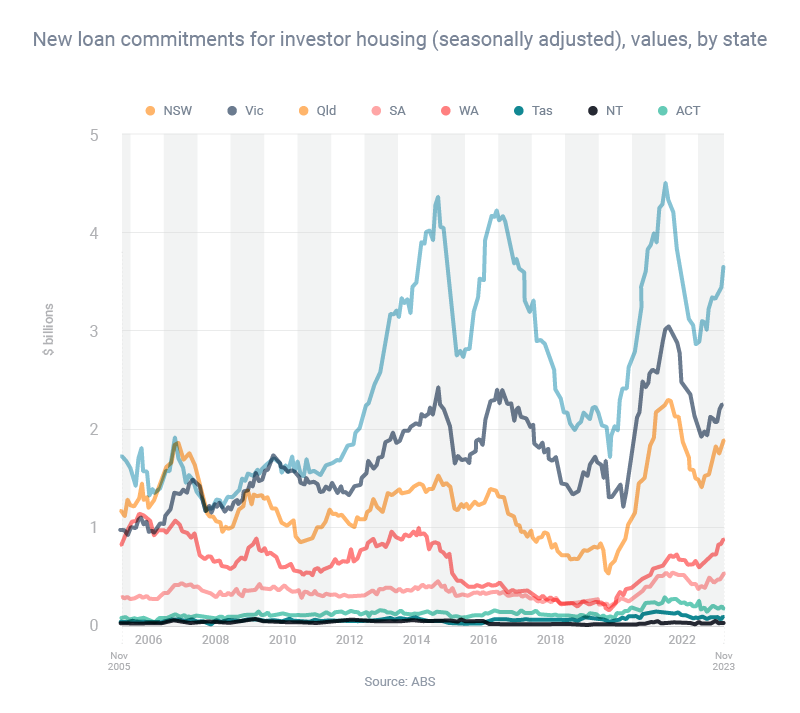

As interest rates move up and down, so does the average person's borrowing power. Borrowing power tended to decline in 2023 and is likely to change again in 2024 as rates evolve. The other point worth mentioning is that your borrowing power can vary significantly from lender to lender. The good news is that I can match you with a bank that wants to lend to someone with your situation.  Every state has recorded a rise in property investor borrowing over the past year, with Western Australia leading the way. Throughout Australia, investors took out $9.72 billion of home loans in November 2023, which was 18.0% higher than the year before, according to the most recent data from the Australian Bureau of Statistics. Looking at the individual states, the year-on-year increases in investor borrowing ranged from 3.5% in Victoria to 42.1% in Western Australia. This strong increase in property investor activity might be because investors are enjoying a double wealth gain right now: during 2023, investors enjoyed increases in both the national median property price (by 8.1%) and national median rent (by 8.3%), according to CoreLogic.

One of the key things to remember with investor loans is that your outcomes can vary significantly from lender to lender. Depending on your financial position and the property you want to buy, different lenders will offer you different loan products, loan sizes and interest rates. As your broker, I will compare the market for you and shortlist lenders that suit someone with your specific scenario. The Australian Taxation Office (ATO) has significantly increased its tax take, in part through a focus on large businesses.

Speaking before the Senate Economics Legislation Committee, ATO Commissioner Chris Jordan said the ATO's net collections in the 2022-23 financial year were $576 billion – up $60.6 billion on the previous year. “Rates of corporate tax compliance in Australia continue to set a very high bar for the rest of the world,” he said. “Since the Tax Avoidance Taskforce commenced in 2016, it has helped secure around $28 billion in additional tax revenue from multinational enterprises, large public and private businesses.” Commissioner Jordan said the ATO's decision to target the big end of town helped send a positive message to smaller businesses. “When the community sees large corporates doing the right thing, we know this has a positive influence on attitudes and behaviour to paying tax,” he said. “Small and medium businesses and individual taxpayers contribute significantly to our bottom line.” Commissioner Jordan also said the ATO wanted “to encourage a culture of paying tax on time and in full”, for businesses of all sizes. |

AuthorRachael Bland – Founder & CEO Archives

February 2024

Categories

All

|

|

Privacy | Credit Guide | FAQs | Calculators

T: 0421 73 88 30 | E: [email protected] Credit Representative Number: 427013 | Australian Credit Licence Number: 391237 | MFAA Accredited Credit Advisor 150638 | Copyright © 2019 Get Smart Results Pty Ltd |

Website by Mint Creative Circle

|

RSS Feed

RSS Feed