|

The Australian Taxation office (ATO) has reminded taxpayers to lodge their taxes by the October 31 deadline or engage with a registered tax agent to avoid late lodgment penalties.

If you have simple tax affairs, you can lodge online, often in under 30 minutes, through the myGov portal. Most of the information you need will already be pre-filled – just check it's correct, add any additional income and claim your legal deductions. The ATO has also stressed the importance of making sure any claims you make for work-related expenses are accurate, which means you can't just automatically copy/paste the previous year's claims. “We want people to get their deductions right on the first go and claim what they are entitled to – nothing more, nothing less. We have a series of 40 occupation and industry-specific guides which you should have a look at,” ATO assistant commissioner Rob Thomson said. “It may be tempting to boost your refund by leaving out income or inflating your deductions – but remember, we have sophisticated data analytics that will pick up returns that look suspicious.” A new report, from Housing Australia, has revealed that about one in three of all first home buyers in the 2022-23 financial year used the federal government’s Housing Guarantee Scheme (HGS) and its three different assistance programs.

Here’s what the typical participant looked like, according to Housing Australia:

Housing Australia has not only taken control of the HGS, but also the National Housing Infrastructure Facility, which provides loans and grants for critical infrastructure to unlock and accelerate new housing supply. The latest Reserve Bank of Australia (RBA) data has shown the impact the RBA's cash rate rises have had on the mortgage market. The key is to compare average interest rates for all outstanding loans in April 2022 – the month before the first rate rise – and August 2023 – the most recent month for which we have data. During that time, the RBA increased the cash rate by 4.00 percentage points. Interest rates for outstanding loans have, on average, increased by less than that amount, in part because some loans were fixed at lower rates. For owner-occupied loans, rates have increased by an average of:

For investment loans, rates have increased by:

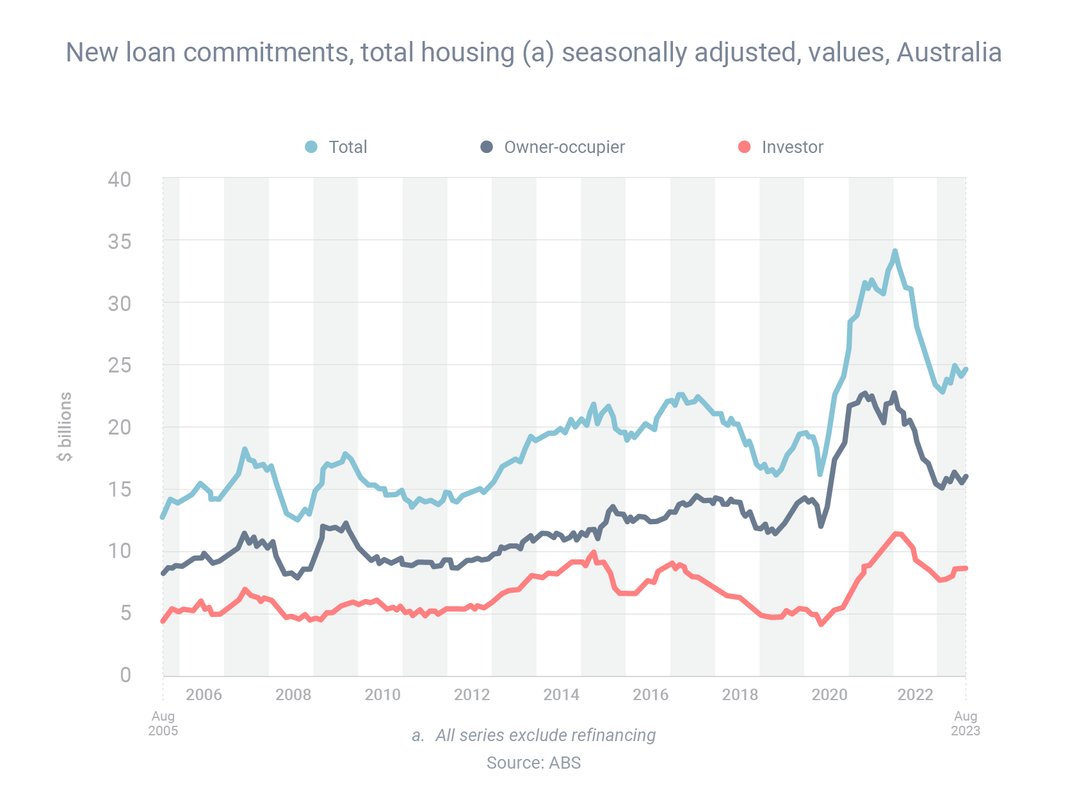

With lots of people coming off fixed rates right now, it’s no surprise that an enormous amount of refinancing is occurring, as borrowers look to switch to lower-rate loans. The latest Australian Bureau of Statistics (ABS) data has revealed that borrowers did $20.60 billion of refinancing in August – which was 3.9% lower than the month before but 12.4% higher than the year before. Meanwhile, the ABS also revealed that the value of all new home loan commitments in August was $24.82 billion, which was 2.2% higher than the month before. Owner-occupier borrowing rose 2.6% to $16.07 billion, while investor borrowing rose 1.6% to $8.75 billion. That said, home loan activity has fallen on a year-on-year basis:

The interest rate environment has changed a lot recently, and the level of competition in the mortgage market is fierce, so there are a lot of great refinancing deals available – including with quality smaller lenders you may be unfamiliar with.

|

AuthorRachael Bland – Founder & CEO Archives

February 2024

Categories

All

|

|

Privacy | Credit Guide | FAQs | Calculators

T: 0421 73 88 30 | E: [email protected] Credit Representative Number: 427013 | Australian Credit Licence Number: 391237 | MFAA Accredited Credit Advisor 150638 | Copyright © 2019 Get Smart Results Pty Ltd |

Website by Mint Creative Circle

|

RSS Feed

RSS Feed