|

While some view LMI as being exclusively beneficial for lenders, we explore the value for first home buyers.

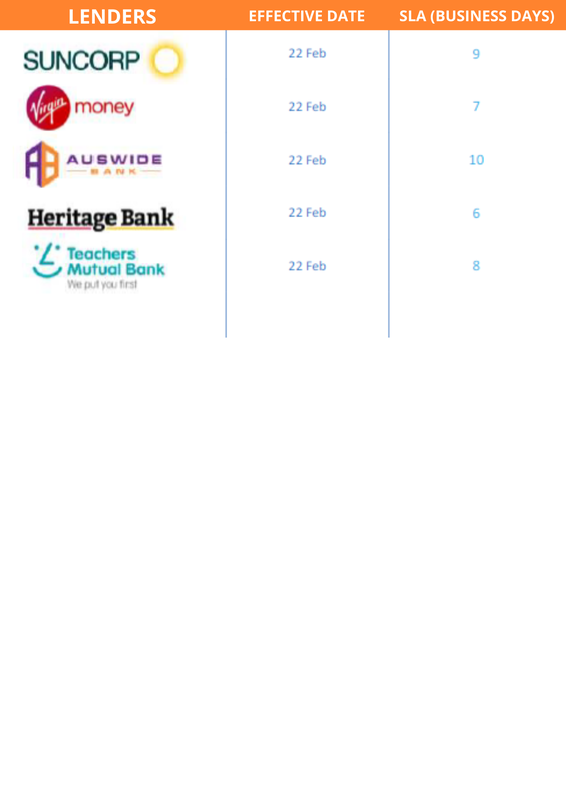

Not to be confused with mortgage protection insurance (which is designed to protect the borrower), LMI is insurance that covers the lender’s risk within a residential mortgage transaction should the loan go into arrears and the borrower is unable to resolve the situation satisfactorily. LMI is a fairly common practice within the industry, particularly for new home buyers who may struggle to save a deposit. It allows an additional fee to be paid by the borrower and usually applies when the loan is more than 80 percent of the purchase property’s price. The purpose of LMI is to ensure security for the lender in case the borrower fails to make loan repayments. Even though the actual house acts as security, the nature of the property market, like any investment class, means there is a chance that its value could decline, resulting in a financial loss for the lender. The cost of the premium is dependent on several factors, such as the loan size and property value, and most insurers are flexible when it comes to the method of payment. It generally equates to around 2-3% of the value of the property you are buying, and given it is a one-off, then it often means you can get into the market sooner. It can either be a one-off upfront premium payment or that premium could be included in the overall cost of the loan and included in monthly repayments. It is not transferable, which means a new loan may require a new fee depending on how much equity the borrower has. What’s in it for me? While it may appear that it is exclusively favourable to the lender, there is value to borrowers in paying the premium. Opting for LMI means it allows a borrower to independently purchase a property sooner than they otherwise might. LMI is the alternative to using a guarantor or having to save for a bigger deposit, both of which are not feasible options for many first home buyers. A deposit of at least 20 percent of the desired loan amount is required for a borrower not to be deemed ‘high-risk’. If you consider that the average price of a home in Sydney is $650,000, that would mean a deposit of around $130,000 is required. The beauty of LMI is that it buys time, which means borrowers with smaller deposits are able to enter the market sooner rather than later. The major benefit of LMI is that it allows the dream of home ownership to become a reality for a lot of first home buyers. To see if this is the case for you, book a meeting and let us help you! With the rapid increase in the number of mortgage lenders offering home loans to consumers, the process is even more complicated than in years past. Fortunately, Get Smart Financial is here to help. We have regular contact with a wide variety of lenders, some of whom you may not even know about. Working with us can save you time! Purchasing a property can be a life-changing experience but the home loan application process can be really daunting if you’re new to the process. We can prepare your application on your behalf and mitigate the risks in your request. See below banks for the current turnaround times. Note: Recently updated SLAs are highlighted in Red

If you have any questions, book in a time with me below. COVID-19 has been it is fair to say, like a really bad B Grade movie with George Clooney nowhere to be seen. At this point, I would even be prepared to give some opportunity to Tom Cruise (sorry Nic) to save the day, but there have been some saving graces amongst all that 2020 has been so far!

1. Refinancing With the low-interest rates, banks at this point are competing hard for customers. A different lender may offer you better features on your loan that you couldn’t get previously, like an offset account, additional repayment and redraw facilities, an interest-only option or a fixed or split-interest option... with rates just above 2%, there are some serious savings to be had if you are able to consider refinancing. If your current lender can’t offer you what you want, it's worth looking for mortgage options that do, and at the best possible rate! 2. First Home Buyer Grant There are a number of select lenders that have been provided quota for the 10,000 Scheme places for the 2020-2021 financial year, and we can assist by guiding you through your lender options, and their respective process, to achieve the best outcome possible.... we are seeing amongst the challenges of 2020, some really exciting outcomes for our First Home Buyers, some of who are really embracing Digital Inspections to achieve some fabulous outcomes! You could be in your first home with as little as 5 percent deposit with the scheme, and if you have a gift from family, and are currently renting which is a substitute for demonstrating your genuine savings, it could be even less. 3. HomeBuilder Grant The Australian government announced HomeBuilder: a $700M housing package for Australians to access $25k grants for building a new home or substantially renovate an existing home. This is available to eligible owner-occupiers including first home buyers and is a time-limited, tax-free grant program to help the residential construction market to get through the Coronavirus pandemic by encouraging the building of a new home and renovations this year... there is more information to be released, so hang on tight, this could be good! 👏🏻 4. Lesser Lenders Mortgage Insurance St. George Bank / Bank of Melbourne announced that their Lenders Mortgage Insurance (LMI) is reduced to $1.00 during the application stage to help their clients into their own home sooner for those with a loan to valuation ratio (loan / purchase price) of 85% or below. From 13 July 2020, St.George Bank is offering to let first home buyers who are borrowing up to $850,000 for a property worth up to $1 million take out LMI for the sum of just $1. This was introduced to account for how Australian first home buyers are re-evaluating their homeownership plans following the COVID-19 pandemic. Interested to know more in any of these trends? Feel free to reach out, book a meeting and let's chat (because I am home all the time... and I miss people, any excuse will do!) With the rapid increase in the number of mortgage lenders offering home loans to consumers, the process is even more complicated than in years past. Fortunately, Get Smart Financial is here to help. We have regular contact with a wide variety of lenders, some of whom you may not even know about. Working with us can save you time! Purchasing a property can be a life-changing experience but the home loan application process can be really daunting if you’re new to the process. We can prepare your application on your behalf and mitigate the risks in your request. See below banks for the current turnaround times. Note: Recently updated SLAs are highlighted in Red

If you have any questions, book in a time with me below. With official interest rates trending downward, shrewd mortgage holders may take the opportunity to call their lender to ask for a better deal.

But when even a small interest rate reduction means potential savings of thousands of dollars, is a simple phone call enough to get you there? In 2020, ‘your interest rate should have a two in front of it’, is common advice for homeowners considering the competitiveness of their loan settings. But while a number of lenders offer lower rates to new customers, it’s not always so simple for existing customers to secure the same outcome. A leading mortgage and finance broker says that if people want a better deal on their mortgage, there are two options: 1. Call your bank and ask them to match the new rate, or 2. Contact your broker and vote with your feet. And although the first option is commonly recommended, lenders aren’t always so obliging when it comes to rate-matching to get you a more affordable mortgage. As an existing client, it can be disheartening to see your bank offer new customers a lower rate to the one you currently have. Lenders regularly try to ‘win’ new customers by offering low rates. It is a great acquisition strategy. But if they refuse to match your current rate to this new offer, you can always contact a broker and refinance with a lender who is hungry to win your business. Mortgage brokers, on average, have access to a panel of 30-40 lenders and this creates opportunity for competition amongst lenders. Mortgage brokers are also in a position to offer you a more in-depth and customised level of service. This can allow them to find their customers a mortgage product that may suit their current needs, wants and circumstances. Want to know more? There is so much to know, and understand... want to get into the driver’s seat and take control of your financial future? Let's have a chat to find out more! |

AuthorRachael Bland – Founder & CEO Archives

February 2024

Categories

All

|

|

Privacy | Credit Guide | FAQs | Calculators

T: 0421 73 88 30 | E: [email protected] Credit Representative Number: 427013 | Australian Credit Licence Number: 391237 | MFAA Accredited Credit Advisor 150638 | Copyright © 2019 Get Smart Results Pty Ltd |

Website by Mint Creative Circle

|

RSS Feed

RSS Feed