|

Home building costs continue to rise sharply, but it appears the worst is behind us.

Residential construction costs rose 11.9% during 2022, after climbing 7.3% in 2021, according to CoreLogic’s Cordell Construction Cost Index (CCCI). The 2022 result was the largest annual increase on record, apart from the period impacted by the introduction of the GST. However, the pace of growth appears to be slowing: prices increased 4.7% in the September quarter, but only 1.9% in the December quarter. CoreLogic construction cost estimation manager John Bennett said, in 2023, costs would be unlikely to rise at the same rapid pace as in the recent past, because rising interest rates and inflation have made consumers, builders and suppliers more cautious. Analysing the price increases, Mr Bennett said:

0 Comments

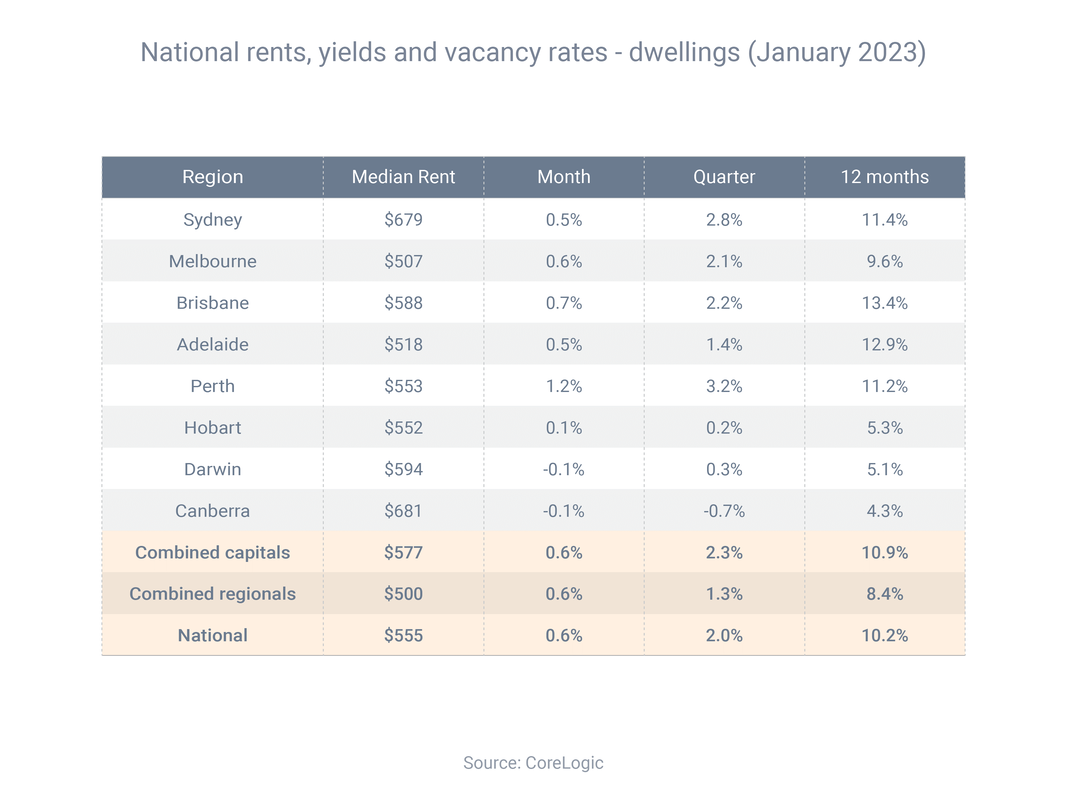

Many property investors enjoyed a big rise in their rental income during 2022. CoreLogic has reported that the median rent for an Australia investment property increased 10.2% during the year. The city-by-city breakdown was:

"Rents are still rising in most capital cities and regional areas, with vacancy rates low," according to CoreLogic head of research Eliza Owen.

Between September 2020 (when this period of rental increases began) and December 2022, Australian rental rates increased 22.2% – the largest increase in a 27-month period in recorded history |

AuthorRachael Bland – Founder & CEO Archives

February 2024

Categories

All

|

|

Privacy | Credit Guide | FAQs | Calculators

T: 0421 73 88 30 | E: [email protected] Credit Representative Number: 427013 | Australian Credit Licence Number: 391237 | MFAA Accredited Credit Advisor 150638 | Copyright © 2019 Get Smart Results Pty Ltd |

Website by Mint Creative Circle

|

RSS Feed

RSS Feed