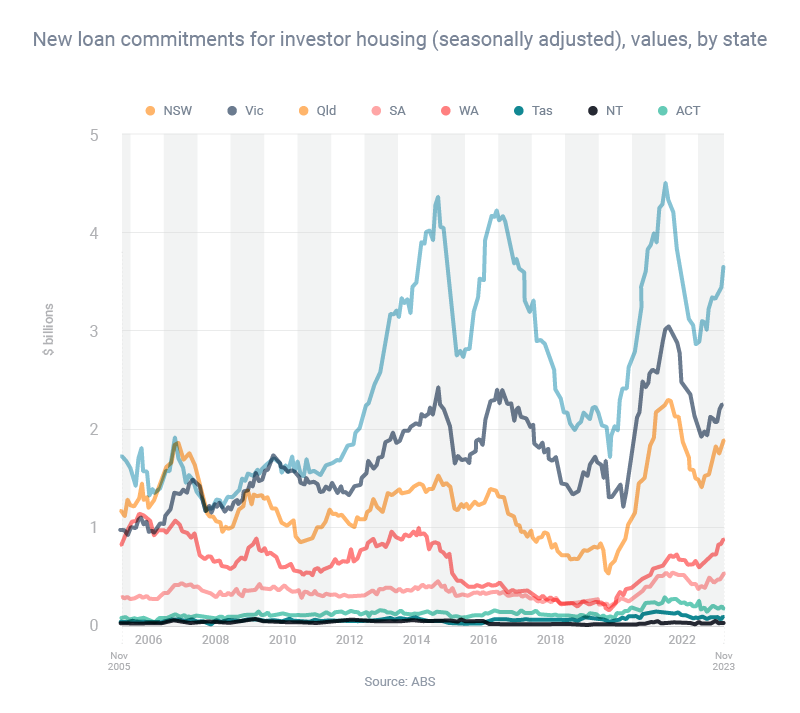

Every state has recorded a rise in property investor borrowing over the past year, with Western Australia leading the way. Throughout Australia, investors took out $9.72 billion of home loans in November 2023, which was 18.0% higher than the year before, according to the most recent data from the Australian Bureau of Statistics. Looking at the individual states, the year-on-year increases in investor borrowing ranged from 3.5% in Victoria to 42.1% in Western Australia. This strong increase in property investor activity might be because investors are enjoying a double wealth gain right now: during 2023, investors enjoyed increases in both the national median property price (by 8.1%) and national median rent (by 8.3%), according to CoreLogic.

One of the key things to remember with investor loans is that your outcomes can vary significantly from lender to lender. Depending on your financial position and the property you want to buy, different lenders will offer you different loan products, loan sizes and interest rates. As your broker, I will compare the market for you and shortlist lenders that suit someone with your specific scenario. Comments are closed.

|

AuthorRachael Bland – Founder & CEO Archives

February 2024

Categories

All

|

|

Privacy | Credit Guide | FAQs | Calculators

T: 0421 73 88 30 | E: [email protected] Credit Representative Number: 427013 | Australian Credit Licence Number: 391237 | MFAA Accredited Credit Advisor 150638 | Copyright © 2019 Get Smart Results Pty Ltd |

Website by Mint Creative Circle

|

RSS Feed

RSS Feed