|

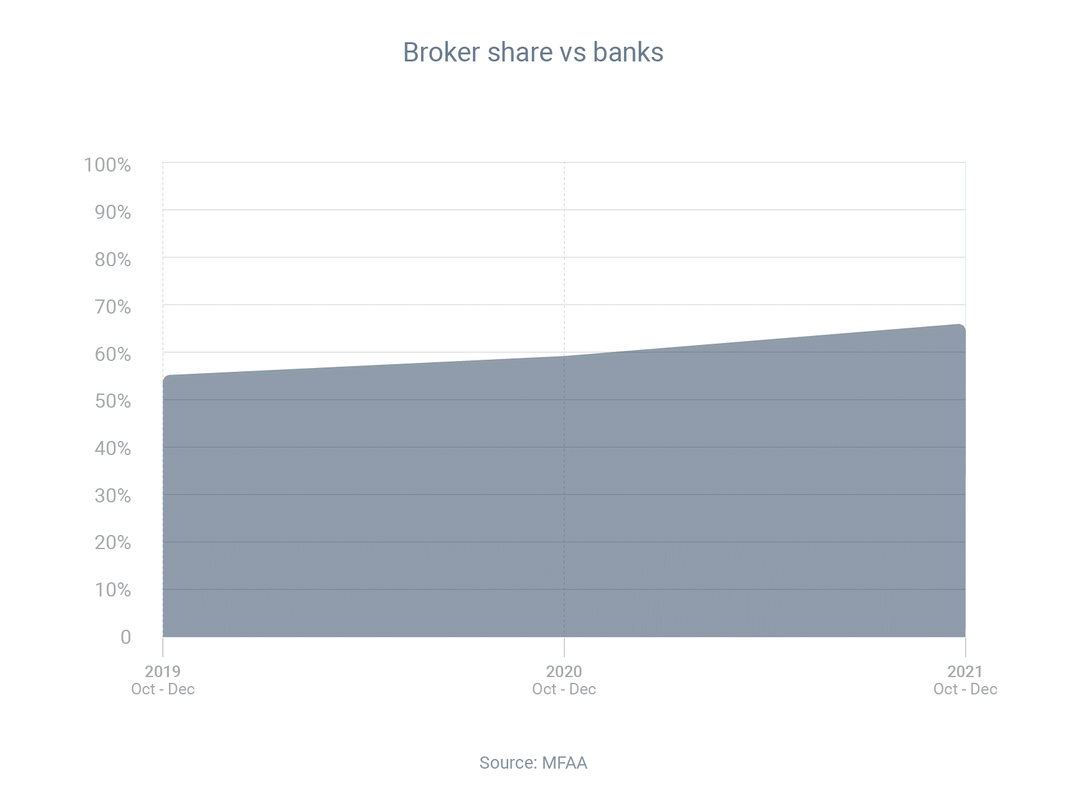

Mortgage brokers were responsible for 66.5% of all new home loans in the December quarter, according to the latest data from research group Comparator. That is not only a record for a December quarter, it's also a significant increase on the market share brokers recorded in December 2020 (59.4%) and December 2019 (55.3%). Mike Felton, the CEO of the Mortgage & Finance Association of Australia, said the strong increase in mortgage broker market share shows that consumers really value the service, competition and choice that brokers provide.

When you visit a bank for home loan advice, the bank will only tell you about its own products, even if it knows another lender is offering a better home loan. But when you visit a broker, the broker will compare interest rates, loan features and borrowing criteria from a range of lenders. The broker will also negotiate with lenders on your behalf. That significantly increases your chances of getting a great loan that’s tailored to your unique circumstances. Comments are closed.

|

AuthorRachael Bland – Founder & CEO Archives

February 2024

Categories

All

|

|

Privacy | Credit Guide | FAQs | Calculators

T: 0421 73 88 30 | E: [email protected] Credit Representative Number: 427013 | Australian Credit Licence Number: 391237 | MFAA Accredited Credit Advisor 150638 | Copyright © 2019 Get Smart Results Pty Ltd |

Website by Mint Creative Circle

|

RSS Feed

RSS Feed