|

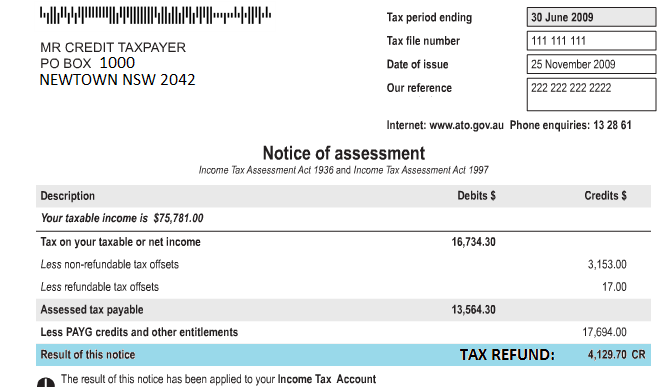

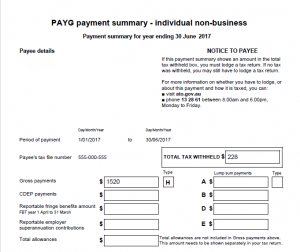

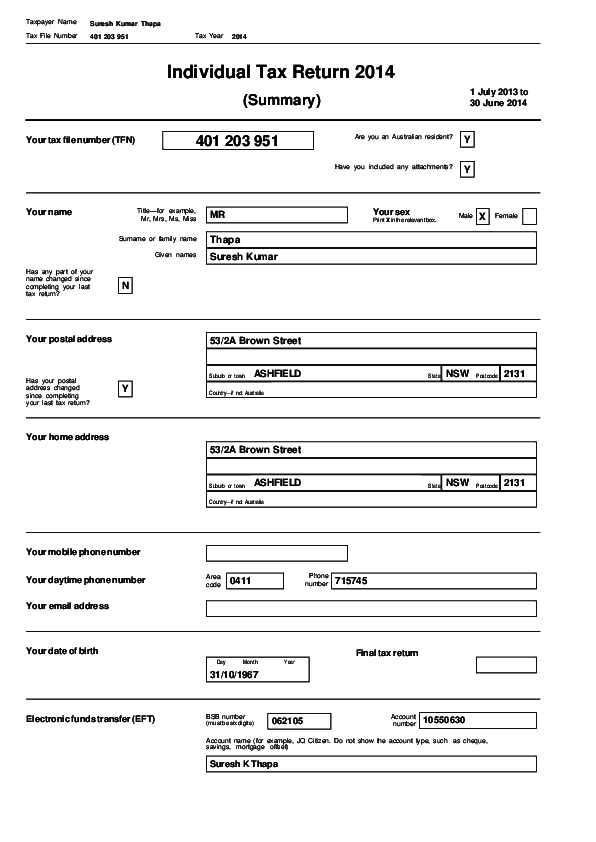

When we are assessing an application for finance, we generally align with the banks and what they request in support documentation in assessing an application for finance. While clients often have ready access to their latest 2 payslips, they sometimes need to go digging a little to find the last 1-2 years of income history for us, being likely what the banks will ask for, and sometimes some confusion as to the difference to a Notice of Assessment, a Payment Summary / Group Certificate, and a Full Tax Return. For context, the difference between the ATO notice of assessment, and the tax return, is that the ATO notice of assessment reflects your taxable income after deductions, not your gross income and the sources it came from. The banks also use the Notice of assessment as proof that what is lodged with your tax return, is in fact what the taxation office actually processed. The full tax return is comprehensive, in providing detail of who you are, where you lived, dependants, health insurance premiums paid, and gross income earned and the businesses earned from. It also details what tax concessions you received, and what tax deductions were claimed. I have attached an example (thanks google!) of each for your reference. The banks will either accept a copy of the PAYG / Group Certificate / Payment summary for the year, OR tax return + ATO notice of assessment. You may be able to download your Payment Summary from here also: https://www.ato.gov.au/individuals/working/working-as-an-employee/accessing-your-payment-summary/ The motivation behind asking for this additional information, is to:

Having trouble to find what we need? Talk to us, let’s work through it together! 4/7/2022 09:03:29 pm

Thanks for writing an article that I found easy to read and understand. I just found this site and am looking forward to reading more of your posts! 12/10/2022 01:56:55 am

Very interesting and thanks for sharing such a good blog. Your article is so convincing that I never stop myself from saying something about it. You’re doing a great job. Keep it. Comments are closed.

|

AuthorRachael Bland – Founder & CEO Archives

February 2024

Categories

All

|

|

Privacy | Credit Guide | FAQs | Calculators

T: 0421 73 88 30 | E: [email protected] Credit Representative Number: 427013 | Australian Credit Licence Number: 391237 | MFAA Accredited Credit Advisor 150638 | Copyright © 2019 Get Smart Results Pty Ltd |

Website by Mint Creative Circle

|

RSS Feed

RSS Feed