|

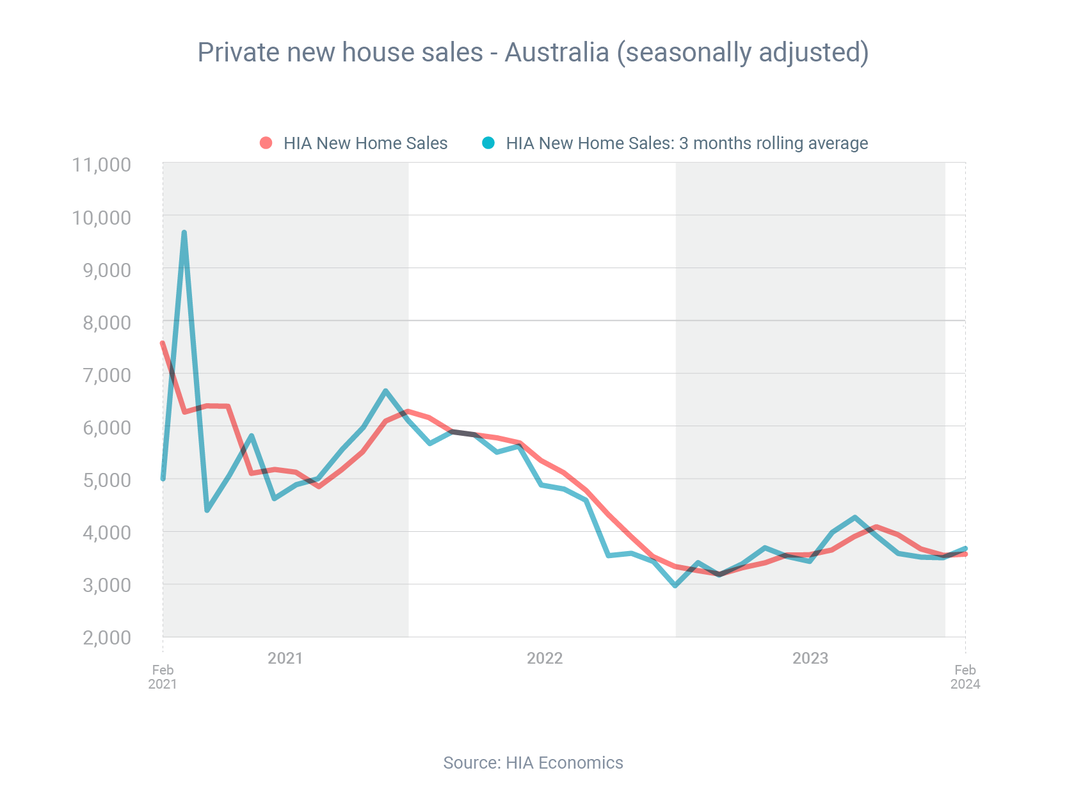

Australians purchased 5.3% more new homes in February than the month before, according to the Housing Industry Association (HIA). However, HIA chief economist Tim Reardon said this increase was off a “very low” base. Based on the number of new homes being approved for construction and purchased, he forecast there would be a decade-low amount of homebuilding activity in 2024, despite the pent-up demand for housing. Nevertheless, banks are still keen to lend to Australians who want to build a new home or renovate an existing one. To finance your project, you’ll need a construction loan (rather than a regular home loan). Here’s how construction loans work:

Comments are closed.

|

AuthorRachael Bland – Founder & CEO Archives

February 2024

Categories

All

|

|

Privacy | Credit Guide | FAQs | Calculators

T: 0421 73 88 30 | E: rachael@getsmartfinancial.net.au Credit Representative Number: 427013 | Australian Credit Licence Number: 391237 | MFAA Accredited Credit Advisor 150638 | Copyright © 2019 Get Smart Results Pty Ltd |

Website by Mint Creative Circle

|

RSS Feed

RSS Feed