|

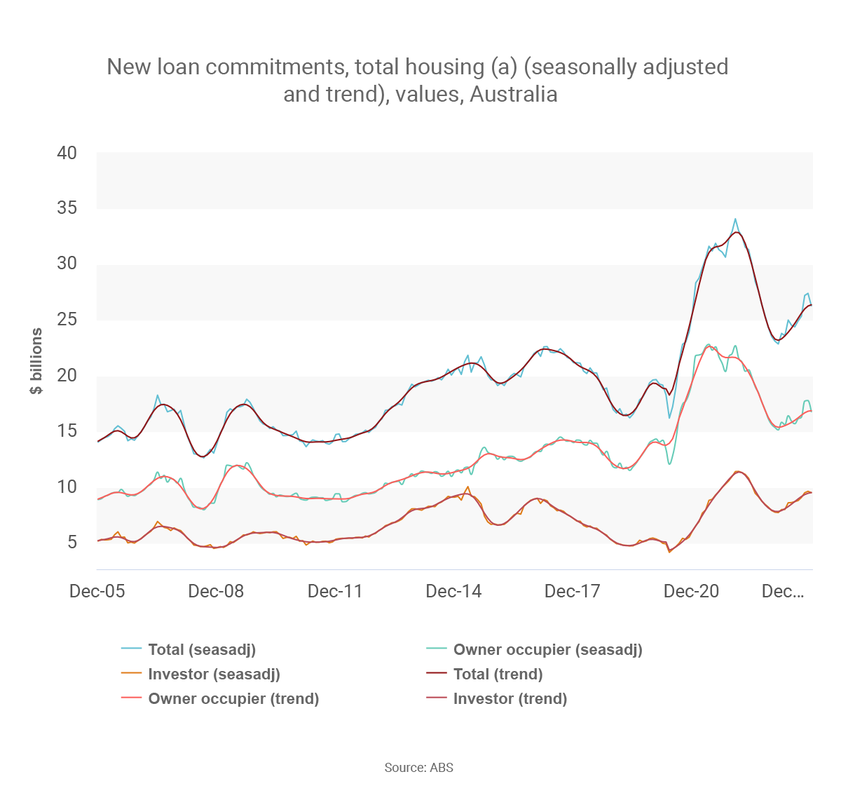

There's been a significant increase in first home buyer activity over the past year, based on the latest data from the Australian Bureau of Statistics. There were a total of 9,491 owner-occupier first home buyer mortgages issued across Australia in December 2023, which was 12.9% higher than the year before. First home buyer activity rose in six of the eight states and territories, with Queensland and Tasmania being the exceptions to the rule. While it can be challenging to buy your first home, this data shows it’s not impossible. Here are four tips to get on the property ladder:

Comments are closed.

|

AuthorRachael Bland – Founder & CEO Archives

February 2024

Categories

All

|

|

Privacy | Credit Guide | FAQs | Calculators

T: 0421 73 88 30 | E: rachael@getsmartfinancial.net.au Credit Representative Number: 427013 | Australian Credit Licence Number: 391237 | MFAA Accredited Credit Advisor 150638 | Copyright © 2019 Get Smart Results Pty Ltd |

Website by Mint Creative Circle

|

RSS Feed

RSS Feed