|

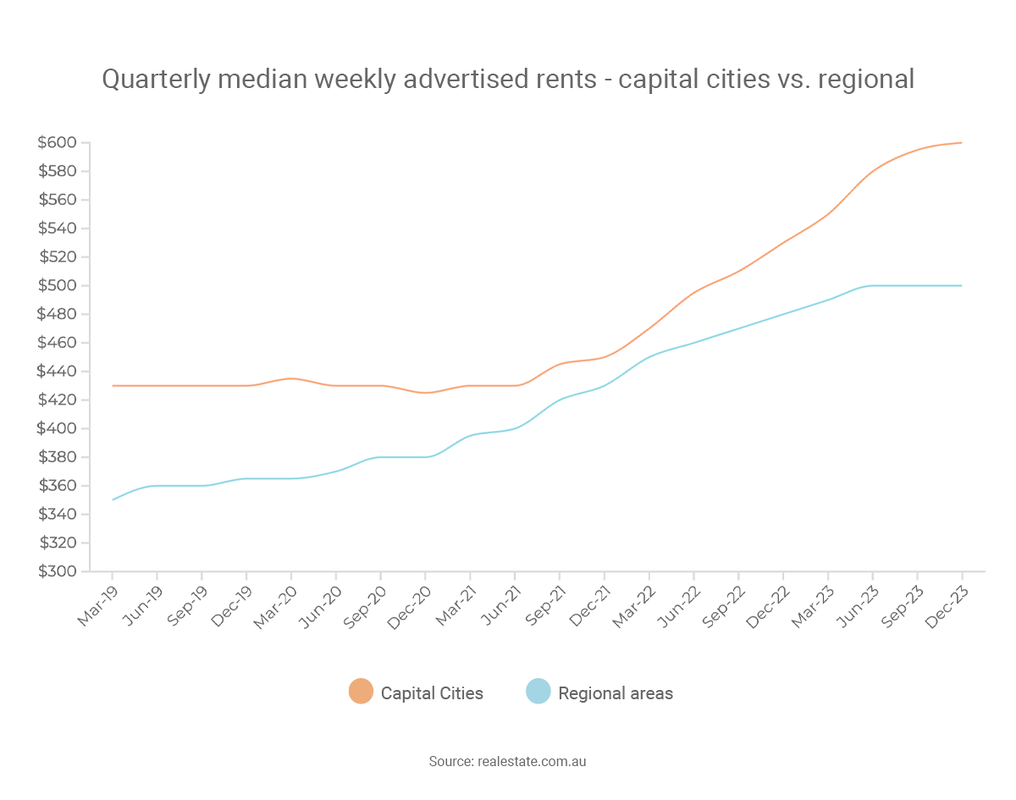

Rents have increased in most capital cities over the past year and are likely to continue rising throughout 2024, according to a leading property data expert. Between the December quarters of 2022 and 2023, the median rent on realestate.com.au rose 11.5%. That included double-digit gains in Perth (20.0%), Melbourne (18.3%), Sydney (16.7%) and Adelaide (12.5%), as well as increases in Brisbane (9.1%) and Darwin (1.7%). By contrast, rents stagnated in Canberra (0.0%) and declined in Hobart (-4.8%). During the same period, the vacancy rate fell from 1.3% to just 1.1%. With rents growing and vacancies falling, this is potentially a good time to be a property investor. PropTrack's director of economic research, Cameron Kusher, forecast that the “tough rental market conditions” would continue.

“We expect supply to remain tight and demand to stay strong, likely pushing rents higher,” he said. “Lending to investors trended higher over 2023, indicating that investors are returning to the housing market. However, many investors continued to sell, resulting in a relatively small pool of rental properties being available for the large number of people seeking accommodation. The rapid increase in Australia’s population exacerbated rental market challenges, as most people migrating to Australia become renters.” Comments are closed.

|

AuthorRachael Bland – Founder & CEO Archives

February 2024

Categories

All

|

|

Privacy | Credit Guide | FAQs | Calculators

T: 0421 73 88 30 | E: rachael@getsmartfinancial.net.au Credit Representative Number: 427013 | Australian Credit Licence Number: 391237 | MFAA Accredited Credit Advisor 150638 | Copyright © 2019 Get Smart Results Pty Ltd |

Website by Mint Creative Circle

|

RSS Feed

RSS Feed