|

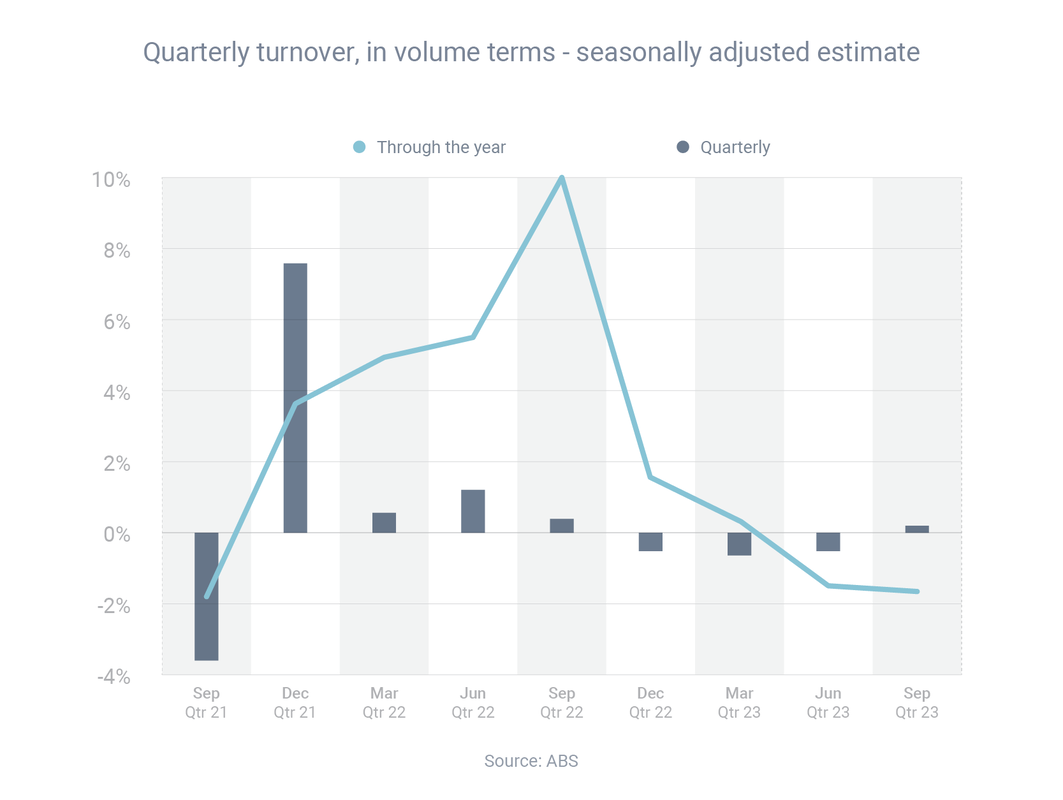

Retail turnover has now increased for three consecutive months, but sales remain at low levels as consumers think twice before spending. Turnover rose 0.9% in September, after previously increasing 0.3% in August and 0.6% in July, according to the Australian Bureau of Statistics (ABS). “The warmer-than-usual start to spring lifted turnover at department stores, household goods and clothing retailers, with more spending on hardware, gardening, and clothing items. Also adding a boost to turnover in household goods retailing was the release of a new iPhone model and the introduction of the Climate Smart Energy Savers Rebate program in Queensland,” ABS Head of Retail Statistics Ben Dorber said. However, he also said that “subdued spending for most of 2023 means that underlying growth in retail turnover remains historically low”.

Retail turnover in September was only 2.0% higher year-on-year. Looking at the different retail categories, the change in turnover was:

The Australian Taxation Office (ATO) has noticed a spike in businesses reporting but not remitting GST, ATO Deputy Commissioner Hector Thompson said in a speech to The Tax Institute's national GST conference.

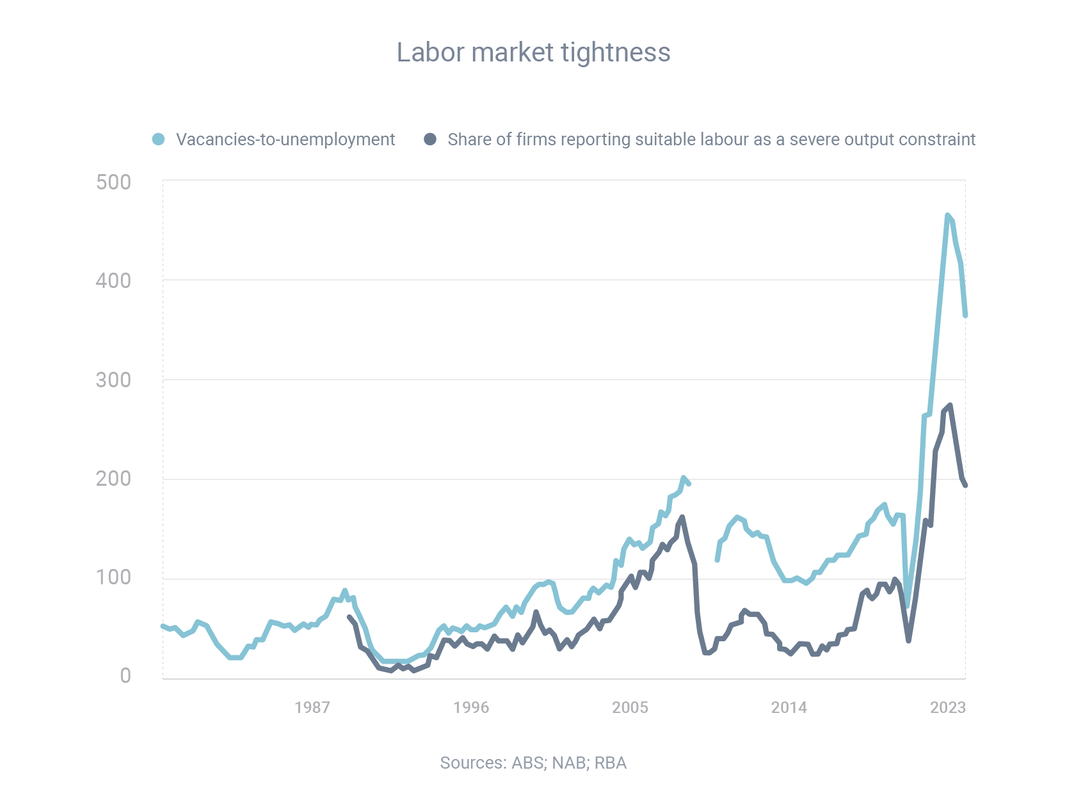

As a result, GST debt more than doubled in the three years to 30 June 2022. “While this increase in debt has been experienced across all taxes the ATO administers, GST debt is growing the fastest. We understand that recent times have been challenging and there will be more challenges ahead. However, reporting, but not remitting GST creates an uneven playing field for businesses that do remit the GST,” he said. Deputy Commissioner Thompson said the ATO was introducing a program to provide accountants with information about potential GST risks. “Over the next four years, we will undertake early intervention engagement activities with registered tax agents who may have clients that exhibit potential GST-related risks. The aim of the program is to educate and leverage agents’ relationships with their clients to positively influence their behaviours and ensure compliance with regulations,” he said. “We will deliver risk alerts to some tax agents providing a view of potential risks in their client base. The intention here is to encourage agents to review their processes and interactions with their clients, and take corrective action, where appropriate.” Broad measures of labour underutilisation have increased over the course of the year as the economy has slowed, according to the latest Statement of Monetary Policy from the Reserve Bank of Australia (RBA). Nevertheless, the job market remains strong, which means the data is giving mixed signals:

As a result, the labour market remains tight and “finding suitable workers continues to be difficult” for businesses.

One interesting trend the RBA has observed is a change in the nature of how businesses are choosing to employ people. “Employment growth has increasingly been driven by part-time employment in recent months. This contrasts to patterns observed during the recovery from the pandemic, when full-time employment accounted for almost all employment growth. Relatedly, average hours worked have declined a little recently and are expected to remain a key margin of adjustment as labour demand eases further,” the RBA said. NAB Monetary Policy Update: RBA to Hold Rates Until Late 2024, Cuts Expected in 2025

Key Points:

Softer Inflation Eases Pressure on RBA:

Outlook for Growth and Labor Market:

Risks and Uncertainties:

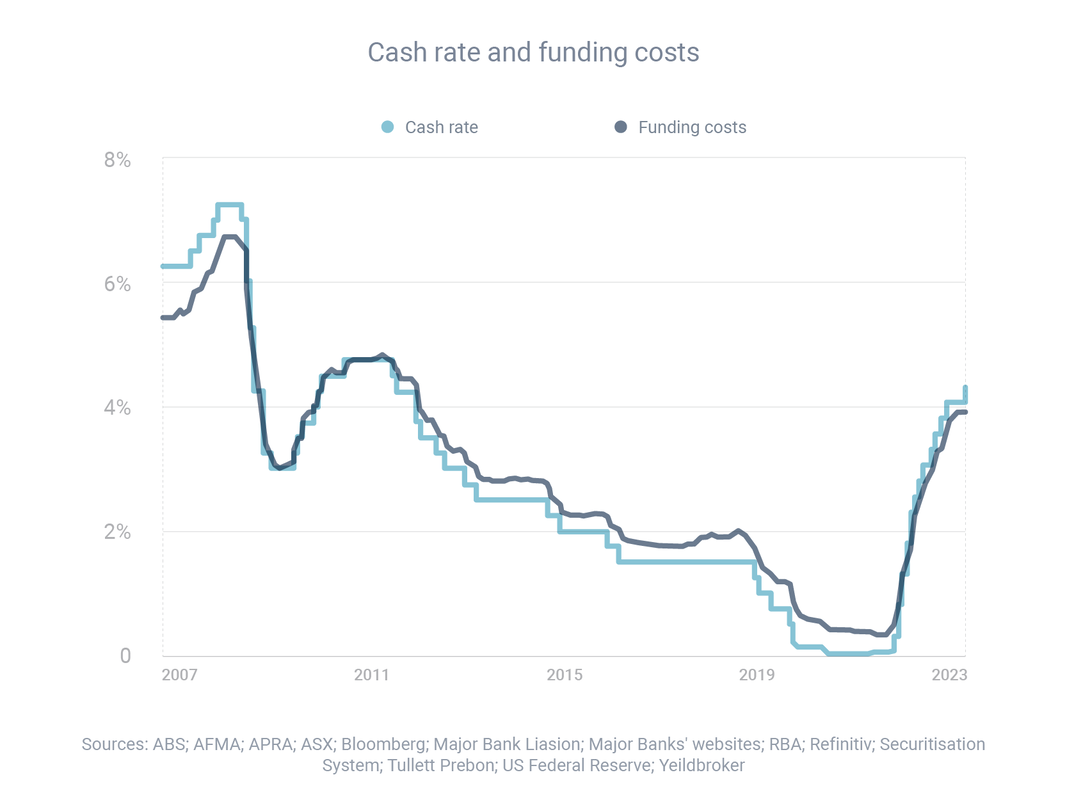

Overall, NAB's revised forecast suggests a period of stability in interest rates before potential cuts in late 2024, with the RBA focusing on balancing inflation and labor market concerns. While interest rates have increased significantly over the past 18 months, this increase, thankfully, has been less than one might have expected, due to competition, according to the Reserve Bank. Between April 2022 and September 2023, the cash rate increased by 4.00 percentage points. However, banks increased their variable rates by, on average, only 3.32 points for owner-occupiers and 3.28 points for investors. This was due, in part, to “the effect of competition between lenders on variable-rate housing loans”. Meanwhile, banks’ funding costs increased further between the June and September quarters, which is likely to lead to higher interest rates and more pain for households.

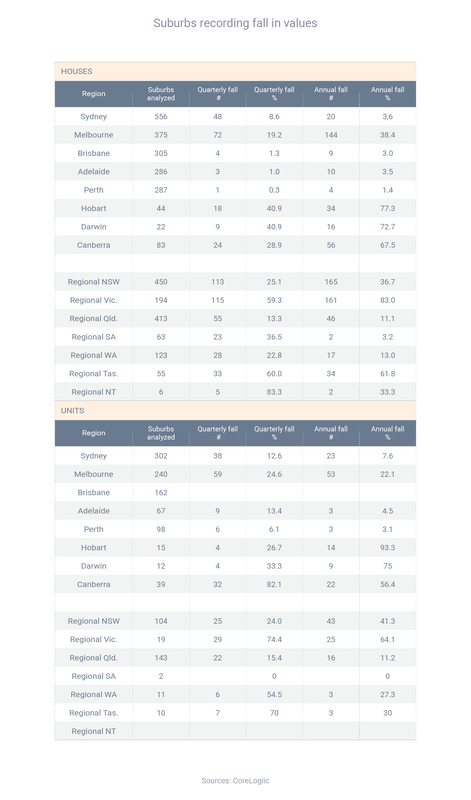

The increase in funding costs came “as banks replaced maturing bonds issued at much lower rates and average deposit rates increased”. Banks generally ‘buy’ funding on the wholesale market, add a margin and then on-sell this money to borrowers in the form of home loans (and other loans). So when banks' funding costs increase, they generally have little option but to increase rates as well. A new report from CoreLogic has found that median property prices increased in 82.4% of local markets in the three months to October, based on a sample of 4,506 suburbs across Australia. That included price increases in 83.1% of house markets and 80.6% of unit markets. Focusing just on house markets, prices increased in:

CoreLogic's head of research, Eliza Owen, said many housing markets across the country were growing, despite high interest rates and weakening economic conditions.

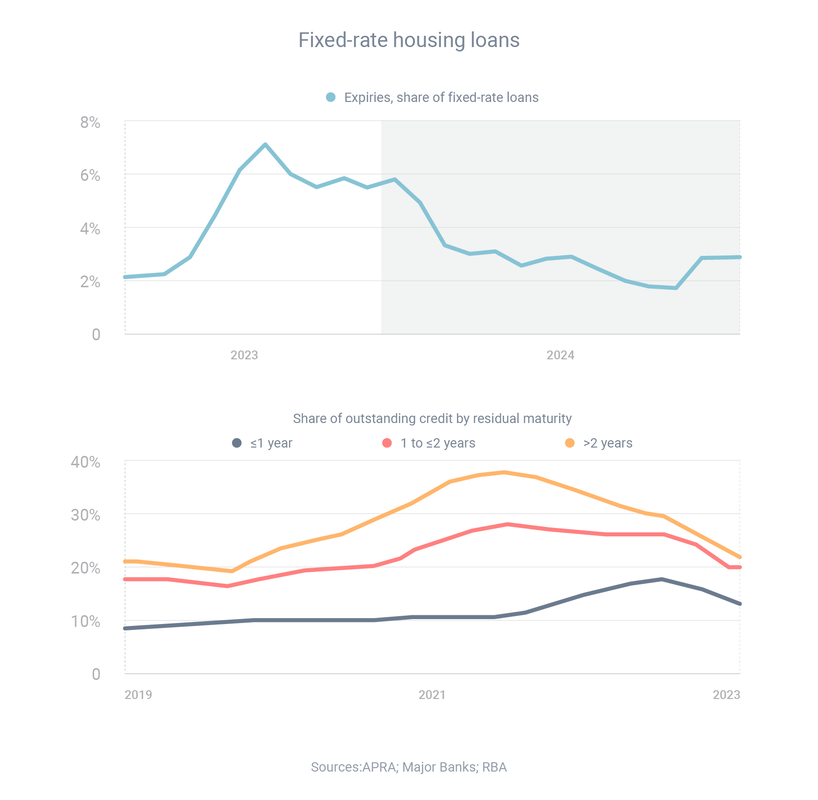

“It’s often noted that Australia is not ‘one housing market’ and we’re currently seeing increased diversity in capital city market performance,” she said. “That’s reflected in city-wide growth rates, the various levels of supply that’s available in some cities over others, and it’s reflected in the different suburbs we analyse in this report.” The great transition of the mortgage market, from having a heavy share of fixed-rate loans to now being dominated by variable-rate loans, has gathered pace, according to Reserve Bank data. During 2020 and 2021, when interest rates fell to record-low levels, enormous numbers of borrowers took out two-year and three-year fixed loans at very low interest rates. Many of those loans then expired as rates started rising, meaning that many borrowers have been reverting from ultra-low fixed rates to significantly higher variable rates. “The fixed-rate share of total outstanding housing credit declined to 22% in September, well below its peak of just under 40% at the start of 2022,” the Reserve Bank reported in its recent Statement of Monetary Policy.

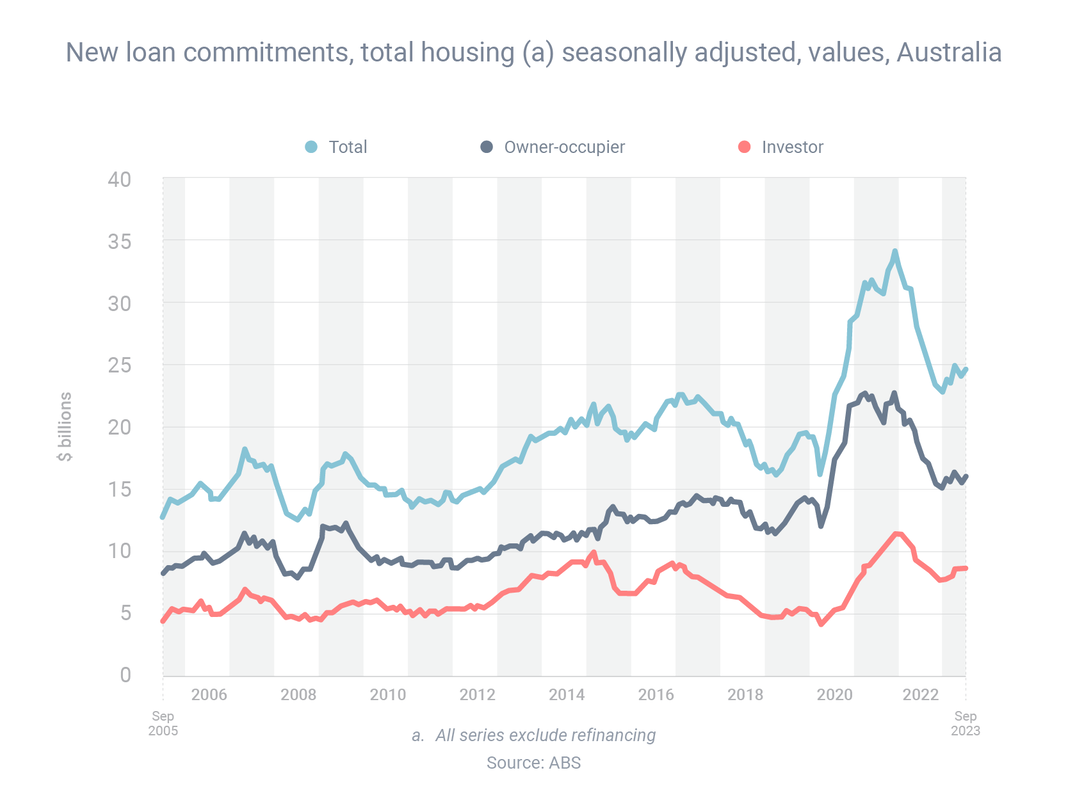

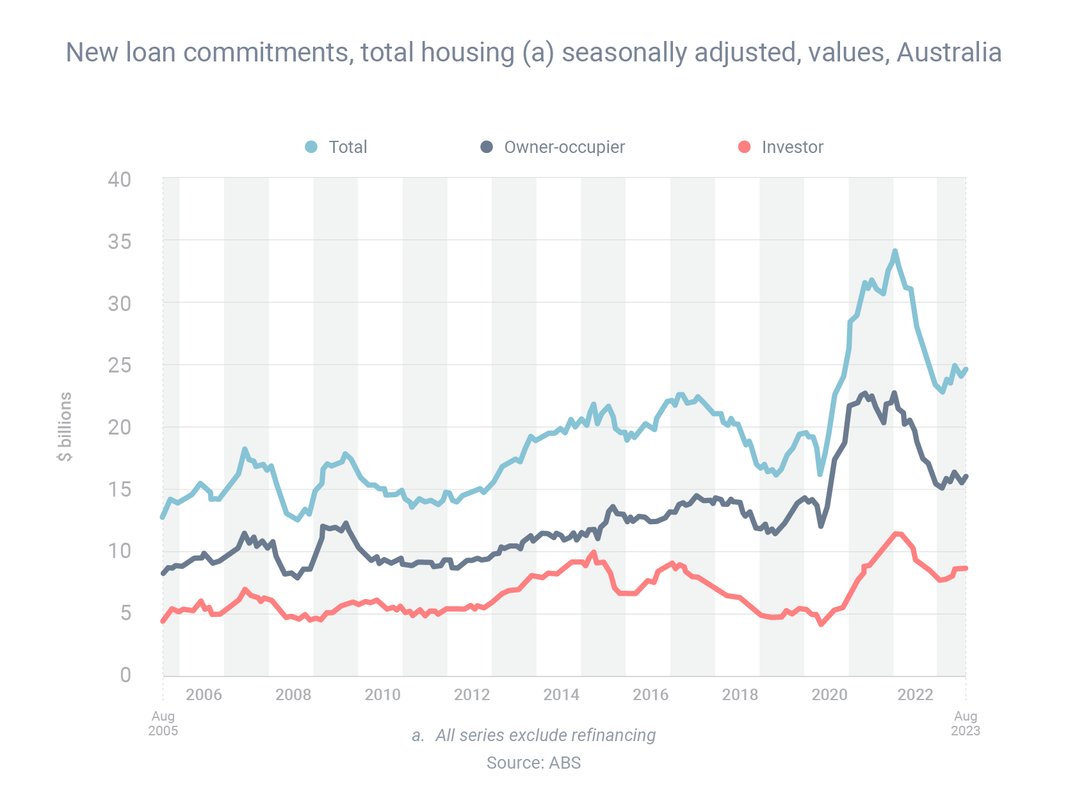

Over recent months, the number of fixed loans that have expired have outweighed the number of new fixed loans that have been initiated, by a ratio of more than five to one. “Most of the remaining fixed-rate loans are expected to expire by the end of 2024,” according to the Reserve Bank. There's been a big rise in home loans activity over the course of the year, with investors leading the way. Between February and September, the total volume of mortgage commitments rose 9.5% to $25.0 billion, according to the latest data from the Australian Bureau of Statistics. Owner-occupied borrowing climbed 6.1% to $16.1 billion, while investor borrowing jumped 16.0% to $9.0 billion. Three other key facts:

The Australian Taxation office (ATO) has reminded taxpayers to lodge their taxes by the October 31 deadline or engage with a registered tax agent to avoid late lodgment penalties.

If you have simple tax affairs, you can lodge online, often in under 30 minutes, through the myGov portal. Most of the information you need will already be pre-filled – just check it's correct, add any additional income and claim your legal deductions. The ATO has also stressed the importance of making sure any claims you make for work-related expenses are accurate, which means you can't just automatically copy/paste the previous year's claims. “We want people to get their deductions right on the first go and claim what they are entitled to – nothing more, nothing less. We have a series of 40 occupation and industry-specific guides which you should have a look at,” ATO assistant commissioner Rob Thomson said. “It may be tempting to boost your refund by leaving out income or inflating your deductions – but remember, we have sophisticated data analytics that will pick up returns that look suspicious.” A new report, from Housing Australia, has revealed that about one in three of all first home buyers in the 2022-23 financial year used the federal government’s Housing Guarantee Scheme (HGS) and its three different assistance programs.

Here’s what the typical participant looked like, according to Housing Australia:

Housing Australia has not only taken control of the HGS, but also the National Housing Infrastructure Facility, which provides loans and grants for critical infrastructure to unlock and accelerate new housing supply. The latest Reserve Bank of Australia (RBA) data has shown the impact the RBA's cash rate rises have had on the mortgage market. The key is to compare average interest rates for all outstanding loans in April 2022 – the month before the first rate rise – and August 2023 – the most recent month for which we have data. During that time, the RBA increased the cash rate by 4.00 percentage points. Interest rates for outstanding loans have, on average, increased by less than that amount, in part because some loans were fixed at lower rates. For owner-occupied loans, rates have increased by an average of:

For investment loans, rates have increased by:

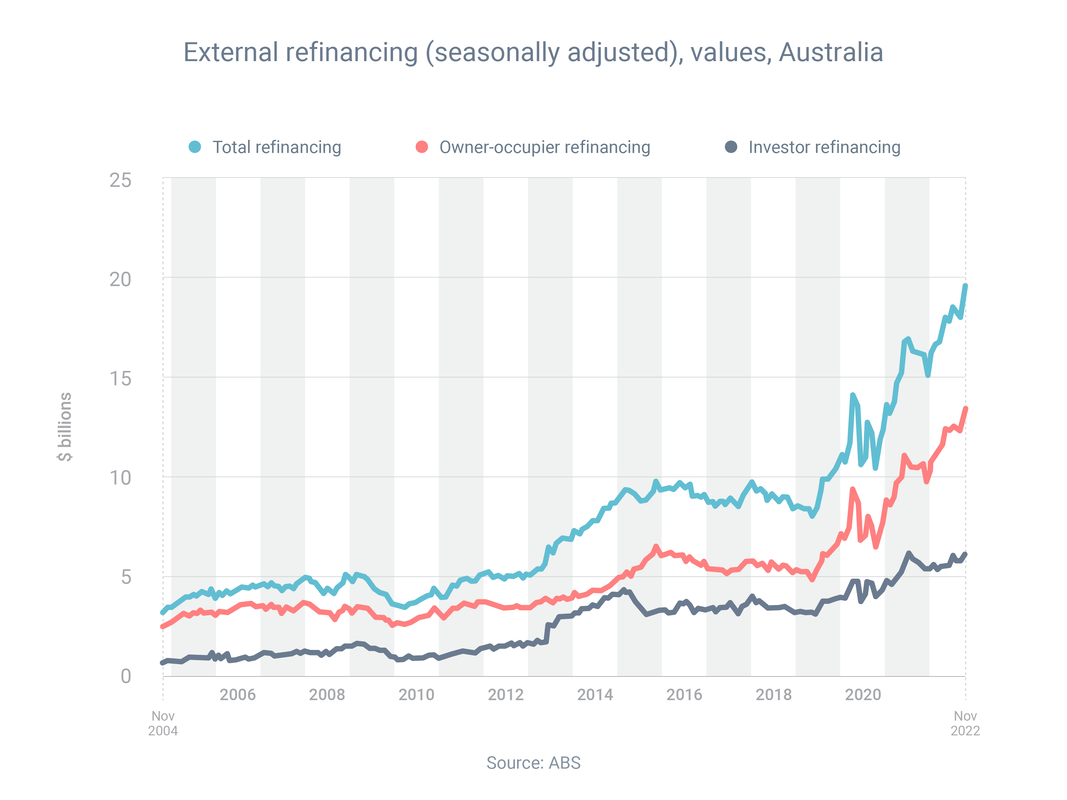

With lots of people coming off fixed rates right now, it’s no surprise that an enormous amount of refinancing is occurring, as borrowers look to switch to lower-rate loans. The latest Australian Bureau of Statistics (ABS) data has revealed that borrowers did $20.60 billion of refinancing in August – which was 3.9% lower than the month before but 12.4% higher than the year before. Meanwhile, the ABS also revealed that the value of all new home loan commitments in August was $24.82 billion, which was 2.2% higher than the month before. Owner-occupier borrowing rose 2.6% to $16.07 billion, while investor borrowing rose 1.6% to $8.75 billion. That said, home loan activity has fallen on a year-on-year basis:

The interest rate environment has changed a lot recently, and the level of competition in the mortgage market is fierce, so there are a lot of great refinancing deals available – including with quality smaller lenders you may be unfamiliar with.

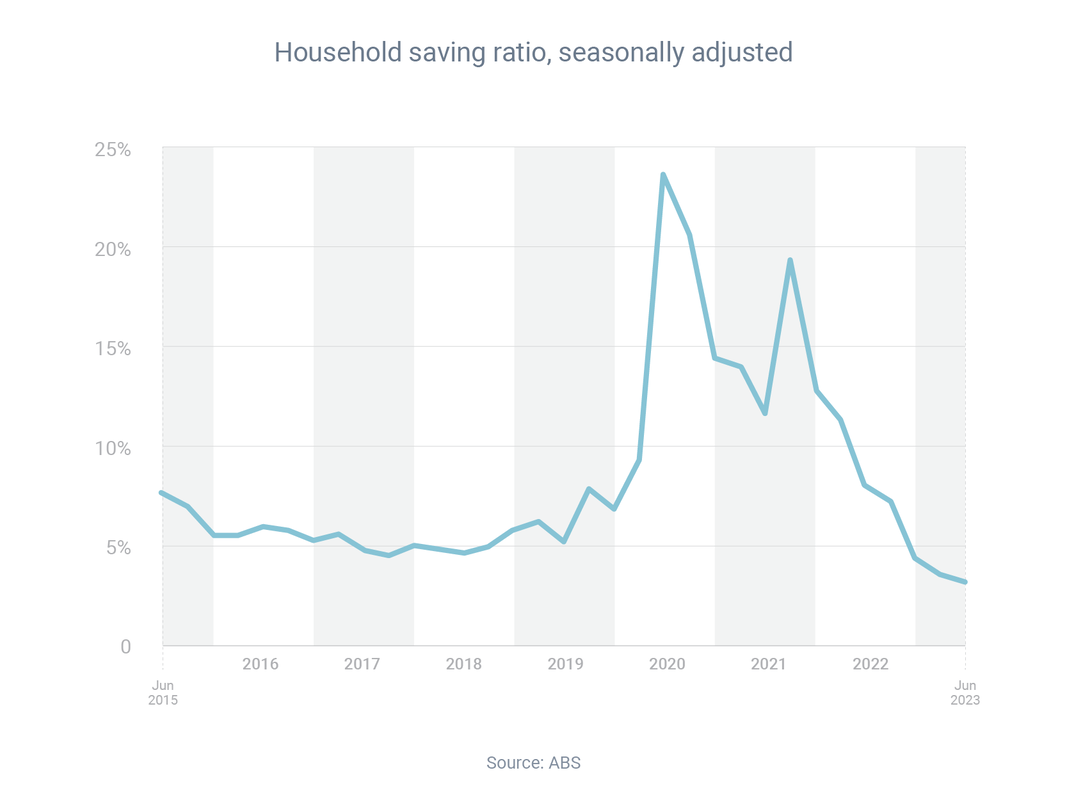

Household savings have now fallen for seven consecutive quarters, suggesting some consumers are finding it harder to save for a home deposit due to rising cost of living. The latest Australian Bureau of Statistics data show that the share of income that households save fell significantly between the quarters of September 2021 and June 2023:

This decline in saving has been partly caused by the pandemic: people spent less during lockdown, because they were stuck at home, and then engaged in 'revenge spending' after being released. But it’s also been caused by the high inflation we’ve experienced during that time, which has forced consumers to spend more money just to buy the same items.

If you have a mortgage and you’re struggling to make repayments, get in touch so we can speak to your lender. Lenders tend to be more flexible with borrowers who get on the front foot about any financial problems they may be experiencing. Interest rates influence property prices, but they are not the reason that Australia has some of the highest housing values in the world, Philip Lowe said in a speech just before standing down as Reserve Bank governor.

Mr Lowe said it's true that the lower interest rates that Australia has experienced for much of the past 30 years have contributed to the increase in property prices. "But the reason that Australia has some of the highest housing prices in the world isn’t interest rates, which have been at roughly similar levels across most advanced economies. Rather, it is the outcome of the choices we have made as a society: choices about where we live; how we design our cities, and zone and regulate urban land; how we invest in and design transport systems; and how we tax land and housing investment," he said. "In each of these areas, our society and politicians have made choices that lead to high urban land and housing costs. It is by tackling these issues that we can address the high cost of housing in Australia, which I view as a serious economic and social problem." The federal government's Home Guarantee Scheme (HGS) is helping first home buyers on modest incomes enter the market with small deposits, according to research commissioned by the National Housing Finance and Investment Corporation.

Some of the key findings from the research were:

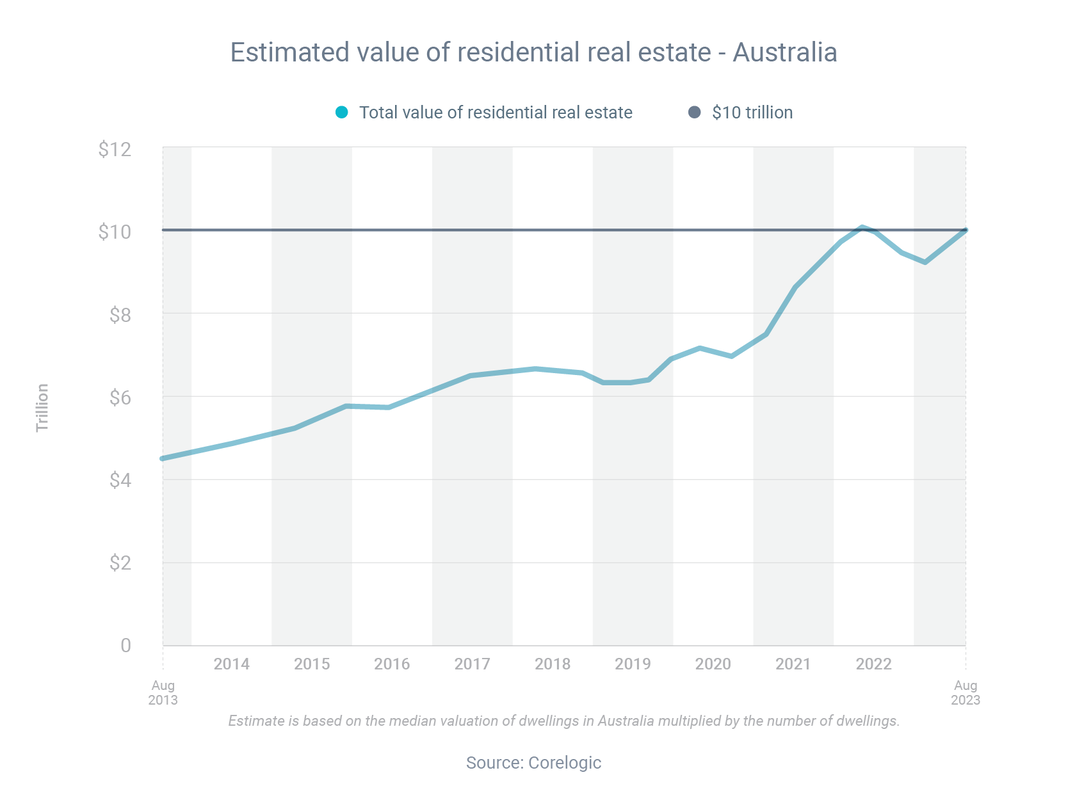

Under the HGS, first home buyers can enter the market with just a 5% deposit – but conditions apply. I can tell you whether you’re eligible and help you apply for a loan. The combined value of Australian real estate reached $10 trillion at the end of August, according to CoreLogic, which is the first time it's reached this level since June 2022. The increase resulted from a combination of more properties being built and the value of Australia's housing increasing. Soon after reaching the $10 trillion mark last year, the property market began a 10-month downswing, during which the national median property price fell 9.1%. Since March, prices have risen in six consecutive months, increasing by a combined 4.9%. However, the outlook is uncertain, according to CoreLogic. “While there is a growing expectation that the RBA board is done hiking the cash rate, borrowing remains constrained by a relatively high serviceability buffer,” CoreLogic said.

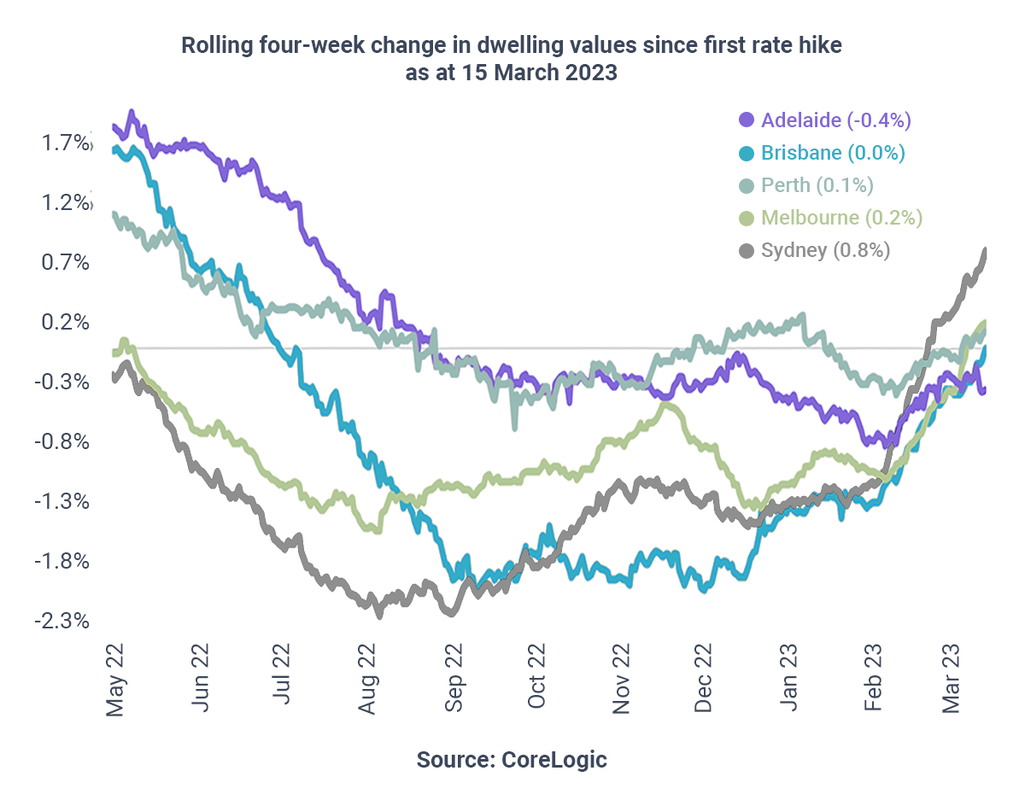

“APRA [banking regulator] data to June showed the weighted average home loan assessment rate was just below 9%, and Australian Bureau of Statistics housing lending data shows mortgage lending has fallen for three of the past four months.” New data from CoreLogic suggests we might be near the end of the housing downturn. While Australia’s median property price fell 0.1% during February, values then rose in some markets in the four weeks to March 15:

That said, it’s too early to call the bottom of the market, according to CoreLogic’s executive research director, Tim Lawless.

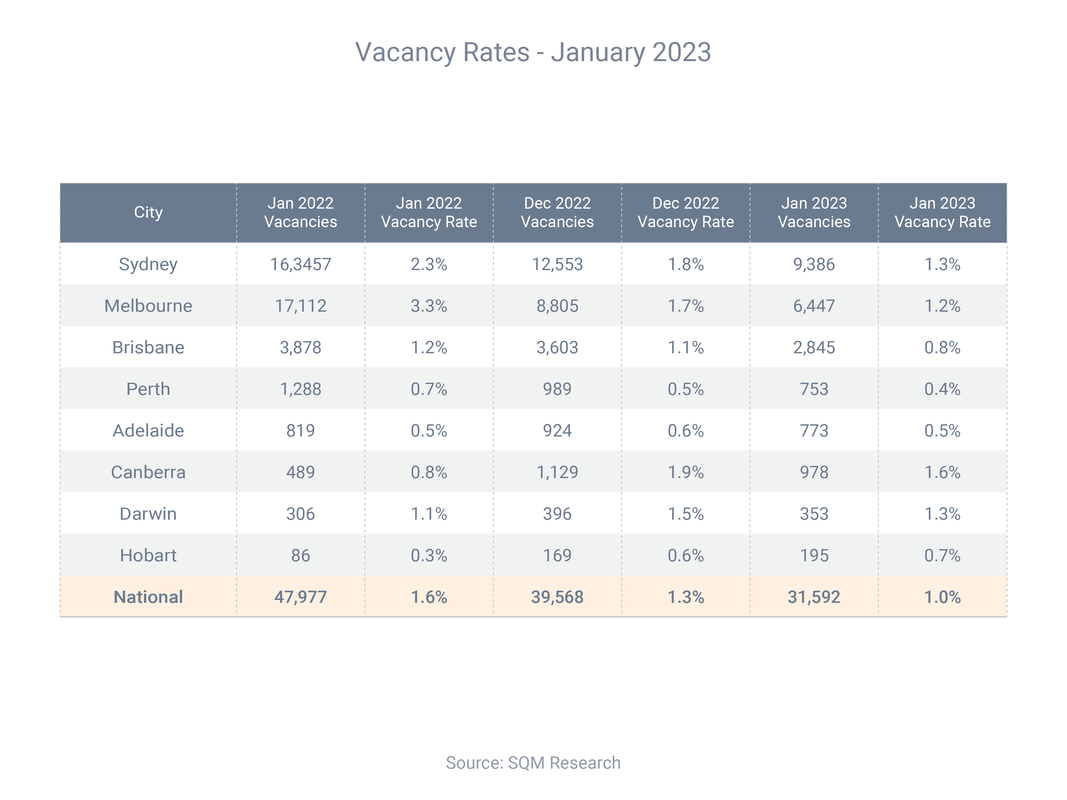

“Interest rates may rise further from here, as well as the fact that we are yet to see the full impact on households from the aggressive rate hiking cycle to date,” he said. “Additionally, economic conditions are set to weaken through the middle of the year, as household savings buffers are being depleted and labour markets are likely to loosen further.” Mr Lawless said one of the key metrics to watch would be the flow of new property listings, as a relative increase in supply would lead to a relative decrease in demand, and “could be a signal this recent trend of growth has run out of steam”. The rental market has turned decisively in favour of property investors, with the number of vacant rental properties plummeting by one-third over a 12-month period. Between January of 2022 and 2023, the number of rental vacancies across Australia fell from 47,977 to 31,592, a reduction of 34.2%, according to SQM Research. At the same time, the vacancy rate – which measures the share of untenanted rental properties – fell from an already-low 1.6% to just 1.0%.

Vacancy rates differ from city to city, but are low throughout the country, ranging from 0.4% in Perth to 1.6% in Canberra. SQM Research managing director Louis Christopher said low vacancy rates were contributing to a “surge in rents”, which in turn was pushing up rental yields. “I believe would-be investors will be attracted to higher rental yields in later 2023, provided the cash rate peaks at below 4% [it's currently 3.35%],” he said Despite the recent housing downturn, property prices are higher in most parts of the country than before the pandemic. As a result, deposit requirements are higher. Domain compared property prices in the December quarters of 2019 and 2022, and found that buyers needed tens of thousands of dollars more today if they wanted to buy a house and put down a 20% deposit. The increase in 20% house deposits for our four biggest cities was:

While the deposit barrier is high, it’s not insurmountable.

As an expert mortgage broker, I can potentially help you enter the market with a low-deposit loan. Generally, if your deposit is lower than 20%, you will need to pay lender’s mortgage insurance (which can be added to your loan). While it’s never nice to pay an added fee, it can be money well spent if it lets you buy a property several years ahead of schedule Home building costs continue to rise sharply, but it appears the worst is behind us.

Residential construction costs rose 11.9% during 2022, after climbing 7.3% in 2021, according to CoreLogic’s Cordell Construction Cost Index (CCCI). The 2022 result was the largest annual increase on record, apart from the period impacted by the introduction of the GST. However, the pace of growth appears to be slowing: prices increased 4.7% in the September quarter, but only 1.9% in the December quarter. CoreLogic construction cost estimation manager John Bennett said, in 2023, costs would be unlikely to rise at the same rapid pace as in the recent past, because rising interest rates and inflation have made consumers, builders and suppliers more cautious. Analysing the price increases, Mr Bennett said:

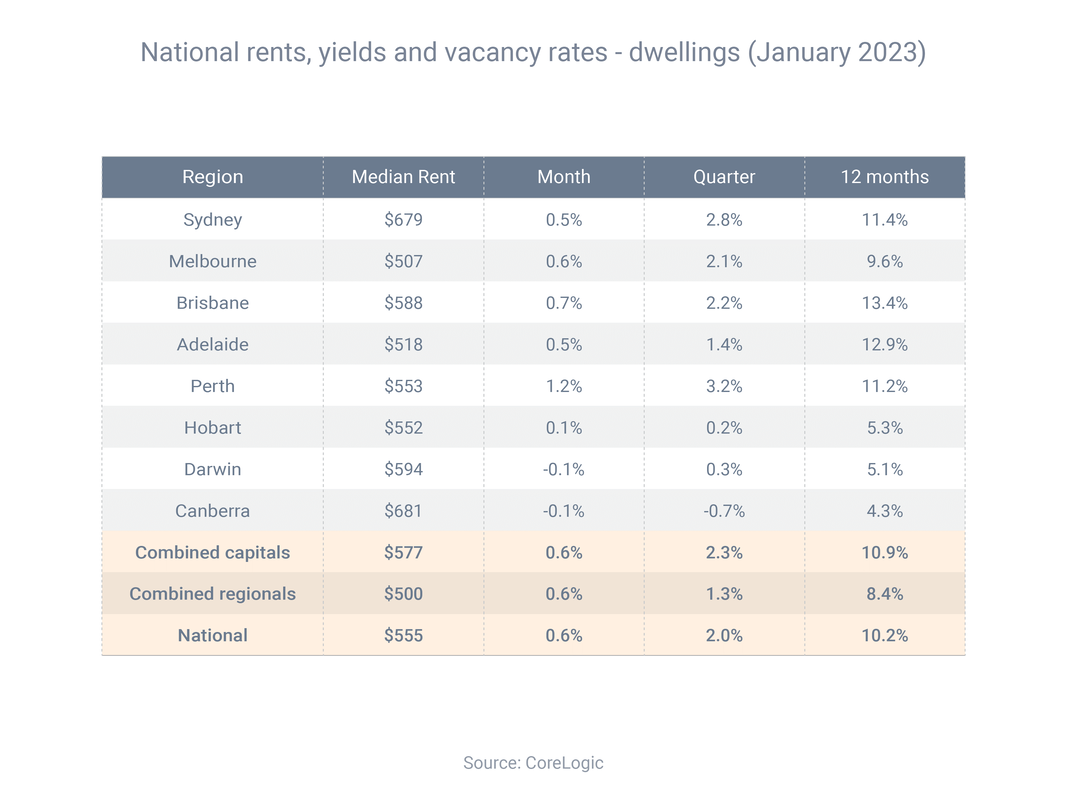

Many property investors enjoyed a big rise in their rental income during 2022. CoreLogic has reported that the median rent for an Australia investment property increased 10.2% during the year. The city-by-city breakdown was:

"Rents are still rising in most capital cities and regional areas, with vacancy rates low," according to CoreLogic head of research Eliza Owen.

Between September 2020 (when this period of rental increases began) and December 2022, Australian rental rates increased 22.2% – the largest increase in a 27-month period in recorded history Refinancing activity is at ultra-high levels right now, as owner-occupiers and investors alike try to find home loans with lower interest rates as the Reserve Bank continues to raise the cash rate. Borrowers refinanced a record $19.5 billion of loans in November, the most recent month for which we have data, according to the Reserve Bank of Australia. By way of comparison, that was 20.4% higher than the year before and 88.2% higher than two years before. The Reserve Bank has hinted that at least one more rate rise is coming. In December, it said it wanted to "return inflation to the 2-3% target range over time" (it's currently 7.3%) and would “do what is necessary to achieve that outcome" – i.e. further increase the cash rate.

So if it’s been a while since you took out your home loan, now would be a good time to think about refinancing. Contact me to get the ball rolling. I’ll be happy to crunch the numbers for you, so you can see if refinancing would be suitable for you and how much money you could save by switching to a comparable lower-rate loan. One of the world’s largest real estate firms has given five very good reasons why “Australian real estate represents a compelling investment”.

I can help you secure finance to buy a property, whether it’s to live in or for investment purposes Home loan activity has fallen since earlier in the year, but demand among first home buyers has held up better than that of other buyer groups.

Between April, when national property prices peaked, and August, the most recent month for which we have data, total home loan commitments fell 13.9%, according to the Australian Bureau of Statistics. However, the decline varied between different buyer groups:

CoreLogic's head of residential research, Eliza Owen, who analysed downturns since 2004, found first home buyer demand for finance during downturns has traditionally been resilient, with smaller falls in demand compared to the other two groups, and sometimes even increases. Ms Owen said there were two reasons for this:

The increase in interest rates over the past six months has made it harder for Australians to qualify for a home loan, and made it more important they get help from a mortgage broker.

Every rate increase of 0.50 percentage points reduces an average borrower’s maximum loan size by about 5%, according to the Reserve Bank’s head of domestic markets, Jonathan Kearns. Since May, the Reserve Bank has increased the cash rate by 2.50 percentage points – which means the average person’s borrowing capacity has fallen by about 25%. The key words here are ‘average’ and ‘about’ – because borrowing capacity varies not just from person to person but lender to lender. Two banks can offer the same borrower very different maximum loan amounts; sometimes, they might be more than $100,000 apart. With borrowing conditions getting harder, it’s vital you seek guidance from an expert broker. I work with a large panel of lenders, so I know which lenders would be more likely to offer finance to someone with your scenario. I can then present your application in such a way as to maximise your chances of approval |

AuthorRachael Bland – Founder & CEO Archives

February 2024

Categories

All

|

|

Privacy | Credit Guide | FAQs | Calculators

T: 0421 73 88 30 | E: [email protected] Credit Representative Number: 427013 | Australian Credit Licence Number: 391237 | MFAA Accredited Credit Advisor 150638 | Copyright © 2019 Get Smart Results Pty Ltd |

Website by Mint Creative Circle

|

RSS Feed

RSS Feed