|

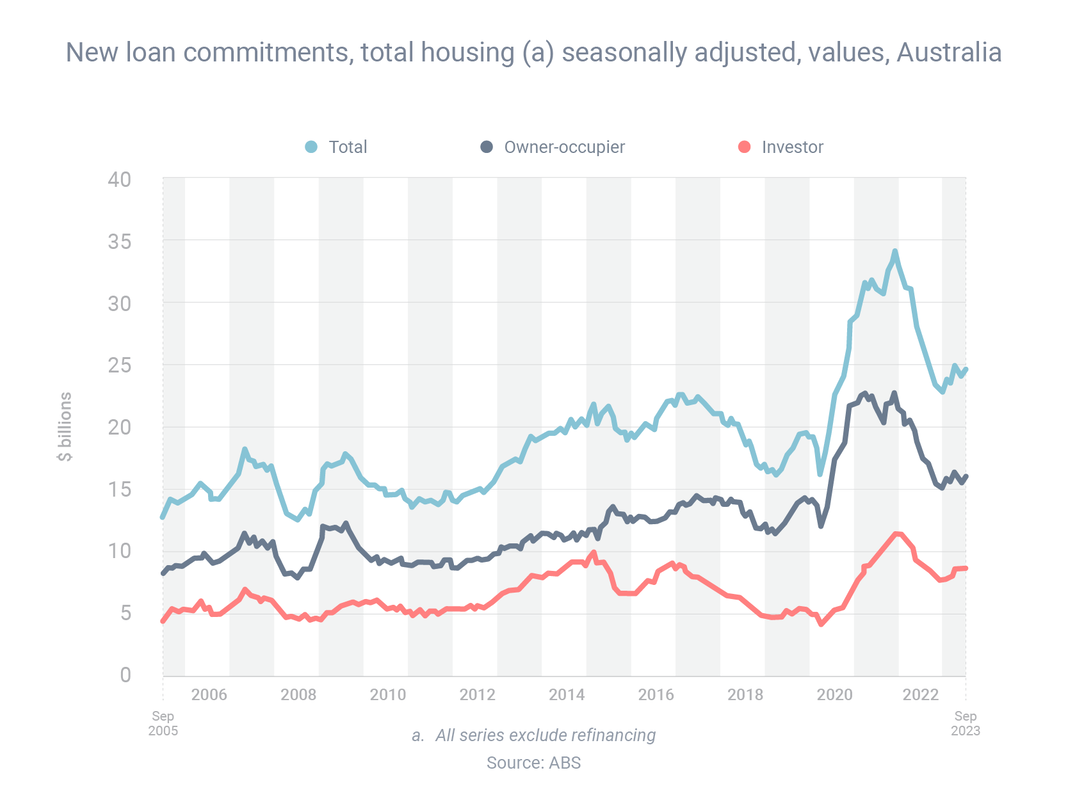

There's been a big rise in home loans activity over the course of the year, with investors leading the way. Between February and September, the total volume of mortgage commitments rose 9.5% to $25.0 billion, according to the latest data from the Australian Bureau of Statistics. Owner-occupied borrowing climbed 6.1% to $16.1 billion, while investor borrowing jumped 16.0% to $9.0 billion. Three other key facts:

Comments are closed.

|

AuthorRachael Bland – Founder & CEO Archives

February 2024

Categories

All

|

|

Privacy | Credit Guide | FAQs | Calculators

T: 0421 73 88 30 | E: [email protected] Credit Representative Number: 427013 | Australian Credit Licence Number: 391237 | MFAA Accredited Credit Advisor 150638 | Copyright © 2019 Get Smart Results Pty Ltd |

Website by Mint Creative Circle

|

RSS Feed

RSS Feed